Must-Have Tools for Successful Credit Repair Business Owners

Have you ever wondered what tools are essential for running a successful credit repair business?

Spoiler alert, the right tools can be game-changers in today’s competitive market.

But which ones? More specifically: What applications do you need for a credit repair business?

As experienced business consultants, we can confidently say that having the right tools is crucial.

Table of Contents

What Tools Do You Need For a Credit Repair Business?

Essential Tools for Effective Credit Repair

Additional Tools for Streamlining Your Business

How to Choose the Right Tools for Your Business

Our Recommended Must-Have Tools for Successful Credit Repair Business Owners

Best Practices for Utilizing Credit Repair Tools

Frequently Asked Questions

Conclusion

Starting and scaling a credit repair business can be challenging.

Want help with your credit repair business?

We have over 10 years of experience scaling credit repair services and using the best tools to generate leads. Get started and our team will conduct a free business audit.

Stay tuned as we dive into the essentials for boosting your credit repair business through strategic tool selection. Plus, outlining the must-haves while sharing practical tips to optimize your operations – all under one guide!

What Tools Do You Need For a Credit Repair Business?

Starting a credit repair business requires more than just expertise in credit management and a passion for helping others improve their financial health.

To truly succeed and scale your operations, you'll need the right tools that can streamline your processes, enhance your productivity, and provide exceptional service to your clients. From comprehensive software solutions to project management tools and communication platforms, the right tools can make all the difference.

But here lies the question: What specific tools do you need to succeed?

Believe it or not, there are seven primary categories of tools essential for credit repair. We’ll dig into each, in the next section.

Essential Tools for Effective Credit Repair

Running a successful credit repair business relies heavily on the tools you use.

Let’s outline these essentials one by one.

Customer Relationship Management (CRM) Systems

A robust CRM system is the backbone of your credit repair business.

By tracking and managing client interactions, a CRM ensures that no client detail slips through the cracks.

The principle behind this is simple: the more organized your client data, the better your service delivery.

Credit Report Software

Another vital tool is credit report software.

This tool allows you to pull and analyze credit reports, making it easier to identify inaccuracies and discrepancies.

Accurate analysis is the cornerstone of effective credit repair.

Dispute Letter Automation Tools

Efficiency is key in credit repair, and dispute letter automation tools help you achieve it.

These tools generate standardized dispute letters quickly, allowing you to handle more cases in less time.

Good Read: Using credit repair software for professionals

Marketing Tools

Marketing is crucial for any business, and credit repair is no exception.

Using tools for email marketing, social media management, and SEO can help attract and retain clients, driving your business growth.

Billing and Invoicing Software

Keeping your finances in order is essential, and billing software simplifies this process.

Automating invoices and payment tracking ensures you get paid on time, every time.

Document Management Systems

Document management systems help you organize and store client documents securely.

This tool ensures that all necessary documents are easily accessible when needed.

Educational Resources

Providing your clients with educational resources about credit management builds trust and empowers them.

Tools for creating and distributing educational content can enhance your service offering.

Additional Tools for Streamlining Your Business

Now that we’ve covered essential tools, let’s delve into some additional tools that can streamline your business operations.

These tools may not be immediately necessary but significantly boost overall efficiency.

Appointment Scheduling Software

Appointment scheduling tools help you manage client meetings effectively.

Automated scheduling reduces no-shows and ensures you maximize your time.

Communication Tools

Tools for efficient communication, like instant messaging apps and video conferencing software, can improve client interactions.

Keeping in touch with clients regularly enhances your service quality.

Project Management Software

Project management tools help you track progress and stay organized.

Whether handling multiple clients or complex cases, these tools keep everything on track.

Accounting Software

Proper financial management is crucial, and accounting software simplifies this task.

These tools help you manage expenses, track revenue, and ensure financial health.

Legal Compliance Tools

Staying compliant with credit repair regulations is non-negotiable.

Tools that help you track and ensure compliance can save you from legal headaches.

Analytics Tools

Understanding your business metrics is vital for growth.

Analytics tools provide insights into client acquisition, retention, and overall business performance.

How to Choose the Right Tools for Your Business

Choosing the right tools for your credit repair business involves careful consideration.

Here are some strategies to help you make informed decisions.

Identify Your Needs

First, assess what your business needs most.

Are you struggling with client management, or do you need better marketing tools? Identifying your priorities helps you focus on the right tools.

Research and Compare

Next, research various tools available in the market.

Compare features, pricing, and reviews to find the best fit for your business needs.

Consider Scalability

Choose tools that can grow with your business.

Scalability ensures you won’t outgrow your tools as your client base expands.

Evaluate Ease of Use

Tools should simplify your operations, not complicate them.

Evaluate the user-friendliness of each tool before making a decision.

Test Before You Commit

Many tools offer free trials.

Utilize these trials to test the functionality and fit before committing to a purchase.

Our Recommended Must-Have Tools for Successful Credit Repair Business Owners

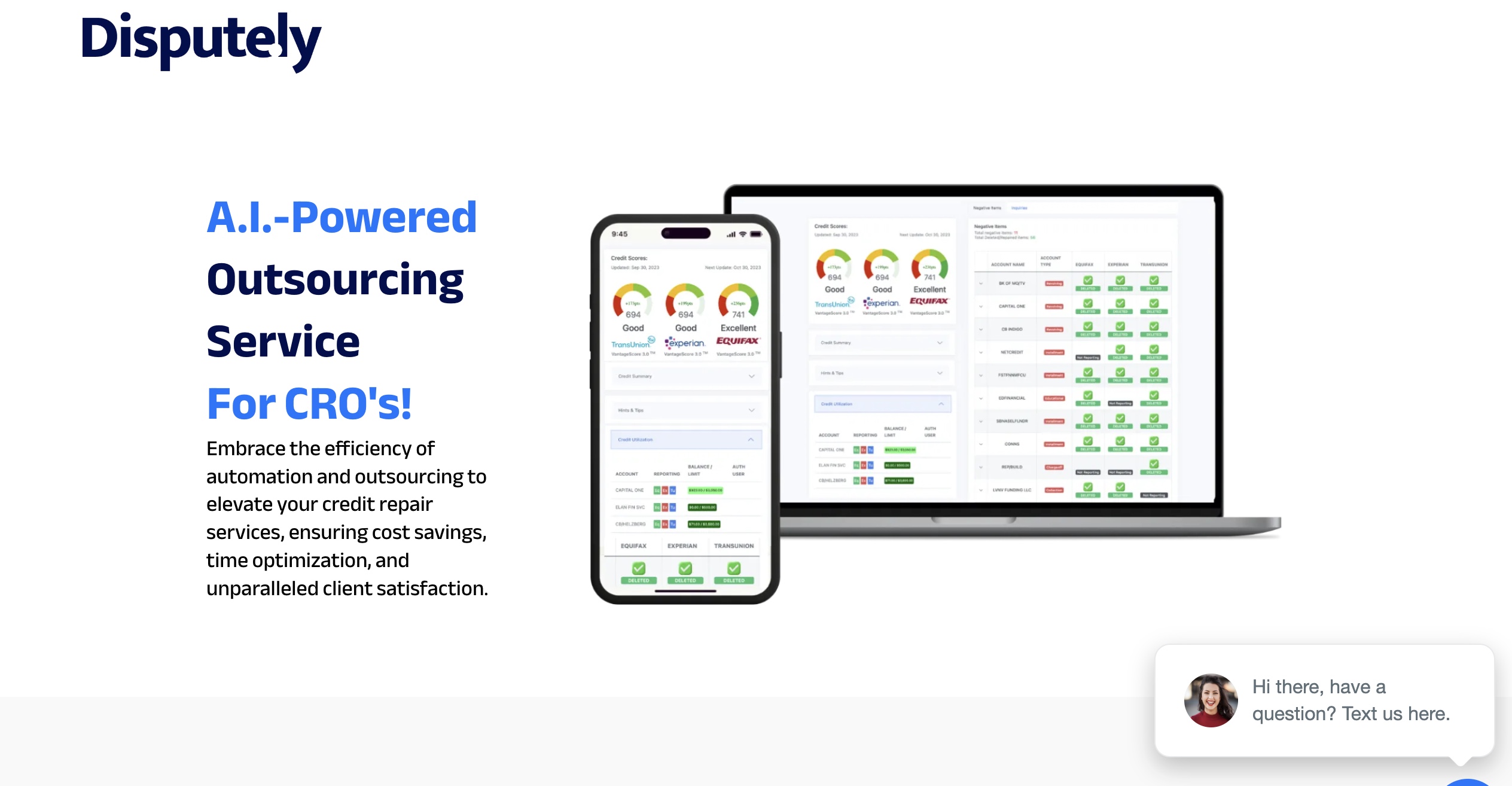

1. Disputely AI: Comprehensive Software for Credit Repair Businesses

What would a credit repair company be without a one-stop-shop for managing all things credit?

I, Joe Mahlow, founder of ASAP Credit Repair, found a way to take my company from start-up to scale-up. This is with the help of the right credit repair software – Disputely. Because of this, I was able to increase my yearly revenue from $120,000 to more than $2 million.

Features of Disputely:

Disputely offers a range of features designed to streamline and enhance the credit repair process for both businesses and individuals:

AI-Powered Analysis: Your tool should use artificial intelligence to analyze credit reports and provide a detailed breakdown of current standings.

Customized Strategic Plans: The platform creates personalized plans to improve credit scores both immediately and over time.

Automated Dispute Generation: Users can automatically generate, print, and mail customized disputes with just one click.

Progress Tracking: The app allows users to track the progress and results of disputes in real-time, offering a hands-off experience.

CRM Integration: Credit repair business owners receive access to a fully automated CRM with features and workflows necessary to manage their business efficiently.

Outsourcing and Automation: Disputely provides an outsourcing membership, processing 10 free clients monthly and offering additional credits on a pay-as-you-go basis.

24/7 Support: The service includes continuous support from an automation expert and a technical team.

Free Access: The basic tools and features of Disputely are offered for free, with an optional premium package for more advanced services.

With Disputely, unleashing your inner credit hero comes naturally as you follow the path trialed and tested by others.

2. ActiveCampaign: Personalized Marketing Automation for Credit Repair

ActiveCampaign helps your credit repair company grow by giving your clients what they need, when they need it.

Benefits of ActiveCampaign:

Create dynamic, customized emails

Automate client journeys based on engagement

Connect to other tools for data sharing

Measure user interaction for deeper insights

The intuitive interface makes it easy to customize ActiveCampaign so that it always does the heavy lifting for you and your team.

3. Zapier: Seamless Integration and Automation

Zapier makes automation a digital breeze by moving information between tools so your hands are free for your best work.

How Zapier Benefits Credit Repair Businesses:

Saves time and reduces errors

Provides a seamless customer experience

Automates tasks such as appointment scheduling and follow-up emails

For instance, if a client schedules an appointment through your website, Zapier can automatically transfer their details to your credit repair software (like Disputely) and trigger an email workflow in ActiveCampaign to provide them with appointment details and follow-up reminders.

4. Asana: Project Management to Avoid Burnout

Setting a goal is easy; seeing it through to completion can be much harder. Asana helps credit repair business owners prioritize tasks, avoid decision fatigue, and prevent burnout.

Key Features of Asana:

Break down missions into bite-sized tasks

Track task details and progress

Collaborate with team members seamlessly

Example: Imagine you have a new client intake process. With Asana, you can create a project with tasks such as initial consultation, document collection, credit analysis, and dispute letter preparation. Each task can have its own set of subtasks, deadlines, and assigned team members. This structure ensures nothing falls through the cracks and the process moves smoothly.

5. Google Suite: Collaboration and Productivity Tools

Many credit repair business owners work remotely and depend on cloud-based tools for seamless collaboration with their team and clients. Google Suite (G Suite) offers a plethora of tools for the modern workforce.

Free Tools in G Suite:

GMail: Reliable email service

GSheets: Collaborative spreadsheets

GSlides: Presentation creation

GHangouts: Messaging and video calls

GCalendar: Sync events and appointments

Setting up a professional email with your domain enhances your business credibility.

6. Acuity Scheduling: Effortless Appointment Management

Credit repair business owners love spending their time talking to people – not scouring calendars trying to find the time to talk to people. Acuity Scheduling alleviates the back-and-forth of emails when arranging meetings.

Advantages of Acuity Scheduling:

Automated appointment reminders

Integration with calendars

Simplified scheduling process

Acuity Scheduling helps you stay organized and focused on client interactions.

7. Slack: Flexible Team Communication

Slack is the digital era’s answer to an office. It’s a chat system where you can share ideas, files, or Friday night plans with the team.

Why Credit Repair Businesses Love Slack:

Integrations with tools like Asana, GDrive, and Zapier

Real-time communication

Organized channels for different projects

Example: Create channels for different aspects of your business, such as #client-intake, #dispute-management, and #marketing. This organization allows your team to quickly find relevant information and communicate efficiently.

8. Twilio: Secure and Versatile Communication Platform

Twilio helps credit repair business owners bring secure voice, video, and messaging communication to their clients.

How Twilio Supports Credit Repair Businesses:

Video chat for monthly check-ins

Messaging on your website to engage leads

Simplified VoIP and traditional calls

Integration with apps for a streamlined workflow

Twilio bridges the distance and keeps communication secure and efficient.

9. HootSuite: Social Media Management for Business Growth

Social media is essential for business growth. HootSuite helps automate your social media presence across numerous platforms simultaneously.

Benefits of HootSuite:

Develop your brand voice

Engage with customers and prospects

Increase brand awareness and inbound traffic

Improve search engine rankings

Successful credit repair business owners use HootSuite to reach and help as many people as possible.

10. Trello: Visual Task Management

Trello is a flexible, visual way to manage tasks and projects. It helps credit repair business owners keep track of various projects and ensure all tasks are completed efficiently.

Advantages of Trello:

Visual boards, lists, and cards to organize tasks

Easy collaboration with team members

Integration with tools like Slack and Google Drive

Example: Create a Trello board for each client, with lists for different stages such as "Initial Consultation," "Document Collection," "Dispute Process," and "Follow-Up." This visual representation helps you see at a glance where each client is in the process and what needs to be done next.

Best Practices for Utilizing Credit Repair Tools

To make the most out of your credit repair tools, following best practices is essential.

Below are strategies you should pay attention to when using these tools.

Regularly Update Your Tools

Keeping your tools updated ensures you have access to the latest features and security patches.

Train Your Team

Ensure your team is well-trained in using the tools.

Proper training maximizes the efficiency and effectiveness of the tools.

Monitor Tool Performance

Regularly monitor how well your tools perform.

If a tool isn’t delivering the expected results, it may be time to consider alternatives.

Integrate Tools Where Possible

Integrating various tools can streamline operations.

Look for tools that offer seamless integration with each other.

Collect Feedback

Gather feedback from your team and clients on the effectiveness of the tools.

This feedback can help you identify areas for improvement and make informed decisions about tool usage.

Frequently Asked Questions

How Do I Start a Credit Repair Business?

Starting a credit repair business involves several key steps:

Research the industry and regulations

Create a business plan

Obtain necessary licenses and certifications

Set up your business infrastructure

Develop a marketing strategy

Invest in essential tools and software

Offering exceptional service and building a strong reputation will help you grow your business over time.

What Are the Most Important Tools for a Credit Repair Business?

The most important tools for a credit repair business include:

CRM systems

Credit report software

Dispute letter automation tools

Marketing tools

Billing and invoicing software

Document management systems

These tools help streamline your operations, improve productivity, and enhance client service.

How Can I Improve My Credit Repair Process?

Improving your credit repair process involves:

Investing in the right tools and software

Streamlining your workflows

Providing regular training for your team

Staying updated on industry trends and regulations

Offering excellent client support and education

Continuous improvement ensures you deliver the best possible service to your clients.

Conclusion

Choosing the right tools for your credit repair business is essential for success.

From CRM systems to dispute letter automation tools, the right tools can streamline your processes, enhance productivity, and provide exceptional service to your clients.

By following best practices and regularly updating your tools, you can ensure your business remains competitive and continues to grow.

Want more clients and better efficiency? Turn your business into a streamlined operation hub. Get started and we’ll conduct a free business audit to see if working together is a good fit.