How to Start a Credit Repair Business: A Comprehensive Guide

Starting a credit repair business can be one of the most rewarding ventures, both financially and personally.

But it’s not just about knowing credit; it’s about providing a service that genuinely helps people get their financial lives back on track.

Before you get started, we know that you are reading this article because:

You are interested in credit repair.

You need credit repair yourself

You are planning to start a credit repair business.

You already have a credit repair business but are still searching for expert opinions regarding growing your business.

As an expert in the credit repair industry with over 17 years of experience in the business, you just came head on. I am confident that by the time you finish this content, you’ll get a solid understanding of the credit repair business.

We will walk you through every step you need to take to successfully start and grow your credit repair business.

How To Start a Credit Repair Business

Understanding What is Credit Repair

Credit repair involves identifying and correcting errors on a client's credit report to improve their credit score. This can include disputing inaccuracies, negotiating with creditors, and offering financial advice to prevent future issues.

According to a 2022 study by the Federal Trade Commission (FTC), 20% of consumers have at least one error on their credit reports. This represents a significant opportunity for credit repair businesses to help clients improve their financial health.

Market Potential

The demand for credit repair services is substantial. The Consumer Financial Protection Bureau (CFPB) reports that the credit repair industry generates over $3 billion in annual revenue. With millions of Americans having errors on their credit reports, there’s ample opportunity for new businesses to thrive.

Legal Requirements and Compliance

Understanding Credit Repair Laws

Before you start, it's crucial to understand the legal landscape. The Credit Repair Organizations Act (CROA) mandates that you provide full disclosure, avoid misleading practices, and inform clients of their rights. Violating CROA can result in hefty fines and damage to your reputation.

Additionally, a survey conducted by the National Association of Credit Services Organizations (NACSO) found that 65% of credit repair businesses faced legal challenges due to non-compliance, highlighting the importance of adhering to these regulations.

State-Specific Regulations

Each state may have additional requirements, such as registration, bonding, and licensing. For instance, California requires credit repair companies to post a bond of $100,000. Ensure you comply with both federal and state regulations to avoid legal issues.

Business Planning and Setup

Writing a Business Plan

A solid business plan is your roadmap to success. Your plan should include:

Executive Summary: Outline your business goals and strategies.

Market Analysis: Research your target market and competitors. According to IBISWorld, the credit repair industry has seen an average growth rate of 4.1% annually over the past five years.

Services Offered: Detail the services you will provide.

Marketing Strategy: Describe how you plan to attract and retain clients.

Financial Projections: Include revenue forecasts, budget, and funding needs.

Choosing a Business Structure

Decide on your business structure—sole proprietorship, partnership, LLC, or corporation. Each has different legal and tax implications. A 2021 study by the Small Business Administration (SBA) showed that 70% of small businesses opted for LLCs due to their flexibility and protection from personal liability.

Registering Your Business

Register your business with state and local authorities. Obtain necessary licenses and permits, and register for an Employer Identification Number (EIN) with the IRS.

Setting Up Your Office

Choosing a Location

While a physical office can add credibility, many credit repair businesses operate successfully from home. According to a report by FlexJobs, 76% of small business owners believe that remote work increases productivity.

Ensure your workspace is professional and equipped with the necessary technology.

Office Equipment and Software

Investing in essential office equipment is crucial for the smooth operation of your credit repair business. However, the right software can make an even bigger difference by streamlining your processes, improving efficiency, and ensuring compliance.

Essential Office Equipment

Computer: A reliable computer is fundamental. Ensure it has adequate processing power and storage to handle your software and client data.

Phone System: A robust phone system is essential for client communication. Consider VoIP services for cost-effective and flexible options.

Secure Filing Cabinets: Physical storage for sensitive documents is important, even in a digital age, to ensure you have secure backups of crucial files.

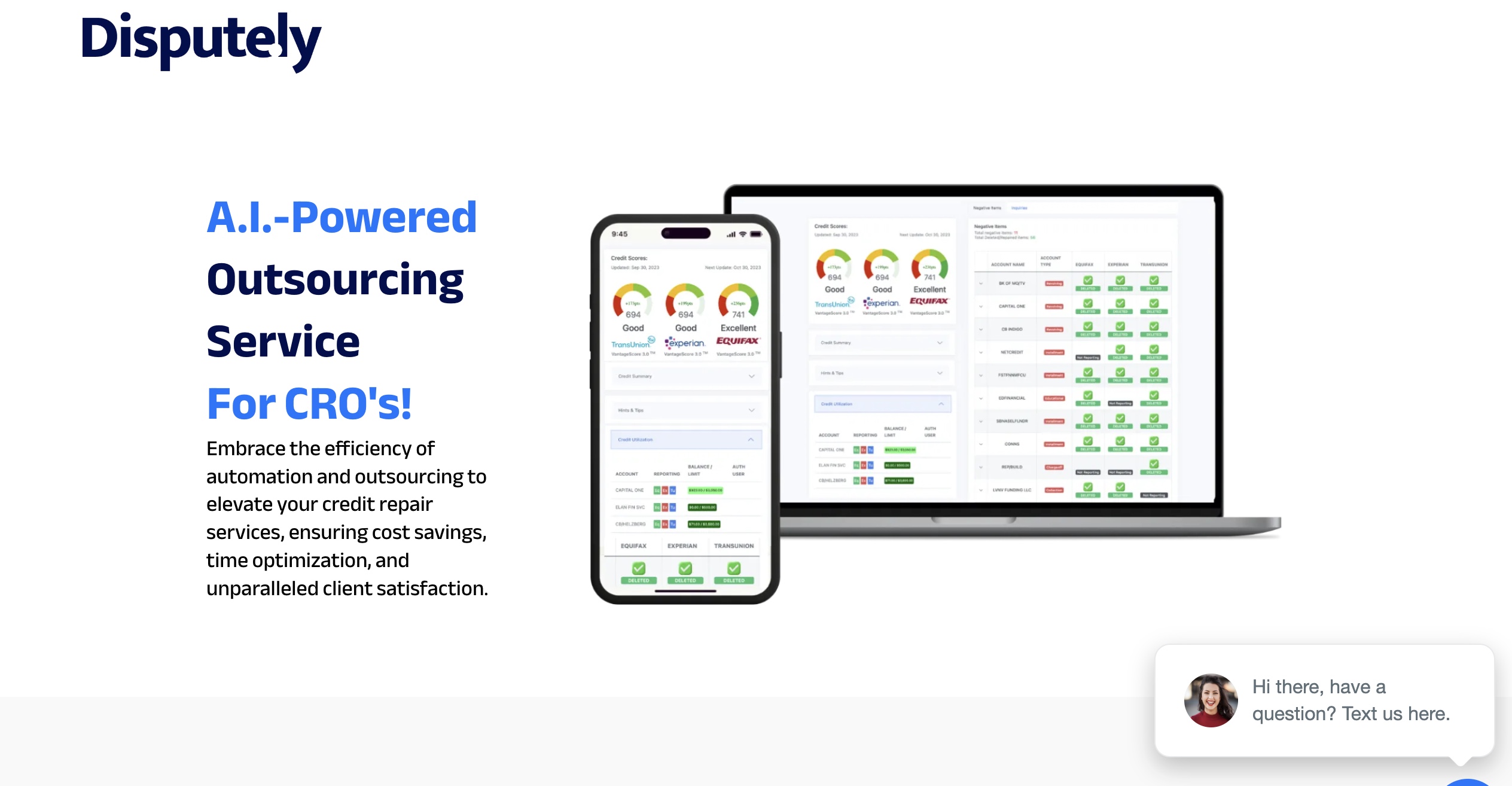

Now let’s shift gear on how credit repair software like Disputely can enhance your business.

Client Management

Centralized Dashboard: Disputely offers a centralized dashboard that allows you to manage all client information in one place. This includes personal details, credit report data, and the status of their disputes.

Automated Updates: The software can send automated updates to clients, keeping them informed about the progress of their credit repair without requiring manual input from you.

Credit Report Analysis

One-Click Import: Disputely enables one-click importing of credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion). This feature saves time and reduces the risk of data entry errors.

Automated Audits: The software can automatically audit credit reports to identify inaccuracies, negative items, and areas for improvement. This ensures no error is overlooked.

Dispute Generation

Customizable Templates: Disputely provides customizable dispute letter templates that comply with the Credit Repair Organizations Act (CROA). These templates can be tailored to fit specific client needs.

Batch Processing: You can generate and send multiple dispute letters at once, increasing efficiency and allowing you to handle more clients.

Progress Tracking

Real-Time Tracking: Track the status of each dispute in real-time. This feature helps you and your clients stay updated on the progress and any changes in their credit reports.

Detailed Reporting: Generate detailed reports on the outcomes of disputes, including what items were removed or corrected. This transparency builds trust with your clients and provides them with tangible results.

Compliance and Security

CROA Compliance: Disputely ensures that all communications and processes are compliant with CROA, helping you avoid legal pitfalls.

Data Security: The software employs robust encryption and security protocols to protect sensitive client data. This is crucial for maintaining client trust and meeting regulatory requirements.

Integration with Other Tools: The software can integrate with other business tools such as CRM systems, accounting software, and email marketing platforms. This creates a seamless workflow across different aspects of your business.

Investing in software like Disputely not only enhances your operational efficiency but also positions your business as a professional and reliable service provider in the credit repair industry. - Credit Repair Business Owner

By leveraging the features and benefits of Disputely, you can offer superior service to your clients and ensure your business runs smoothly and successfully.

Building Your Team

Hiring Staff

As your business grows, you may need to hire staff. Look for employees with experience in credit repair, customer service, and sales. Provide comprehensive training to ensure they understand your processes and compliance requirements.

Training and Development

Continuous training is vital. According to the Association for Talent Development, businesses that invest in comprehensive training programs see 218% higher income per employee than those with less comprehensive training.

Developing Your Services

Core Services

Identify your core services:

Credit Report Analysis: Reviewing clients’ credit reports to identify errors.

Dispute Resolution: Contacting credit bureaus and creditors to correct inaccuracies.

Credit Counseling: Advising clients on maintaining good credit habits.

Additional Services

Offering additional services can set you apart. These might include debt settlement, credit monitoring, and financial education.

A study by Javelin Strategy & Research found that 25% of consumers are willing to pay for credit monitoring services, indicating a strong market demand.

Marketing Your Business

Building a Website

A professional website is crucial. It should include information about your services, client testimonials, and an easy way for potential clients to contact you. According to a survey by BrightLocal, 87% of consumers read online reviews for local businesses, making client testimonials a powerful tool.

Search Engine Optimization (SEO)

A study by Backlinko found that the first result on Google’s search results page gets 31.7% of all clicks. Optimize your website for search engines to attract organic traffic. Use relevant keywords, create high-quality content, and build backlinks.

Social Media Marketing

Utilize social media platforms like Facebook, Instagram, and LinkedIn. Share valuable content, engage with your audience, and run targeted ads.

Networking and Partnerships

Build relationships with real estate agents, mortgage brokers, and financial advisors. Attend industry events and join professional associations like NACSO to expand your network.

Managing Client Relationships

Client Onboarding

Develop a smooth onboarding process. This includes an initial consultation, explaining your services and fees, and setting realistic expectations for the credit repair process. A report by HubSpot found that businesses with a well-defined onboarding process see a 50% higher client retention rate.

Communication and Reporting

Maintain regular communication with clients. Provide monthly reports detailing the status of their disputes and any improvements to their credit score. This transparency builds trust and keeps clients informed.

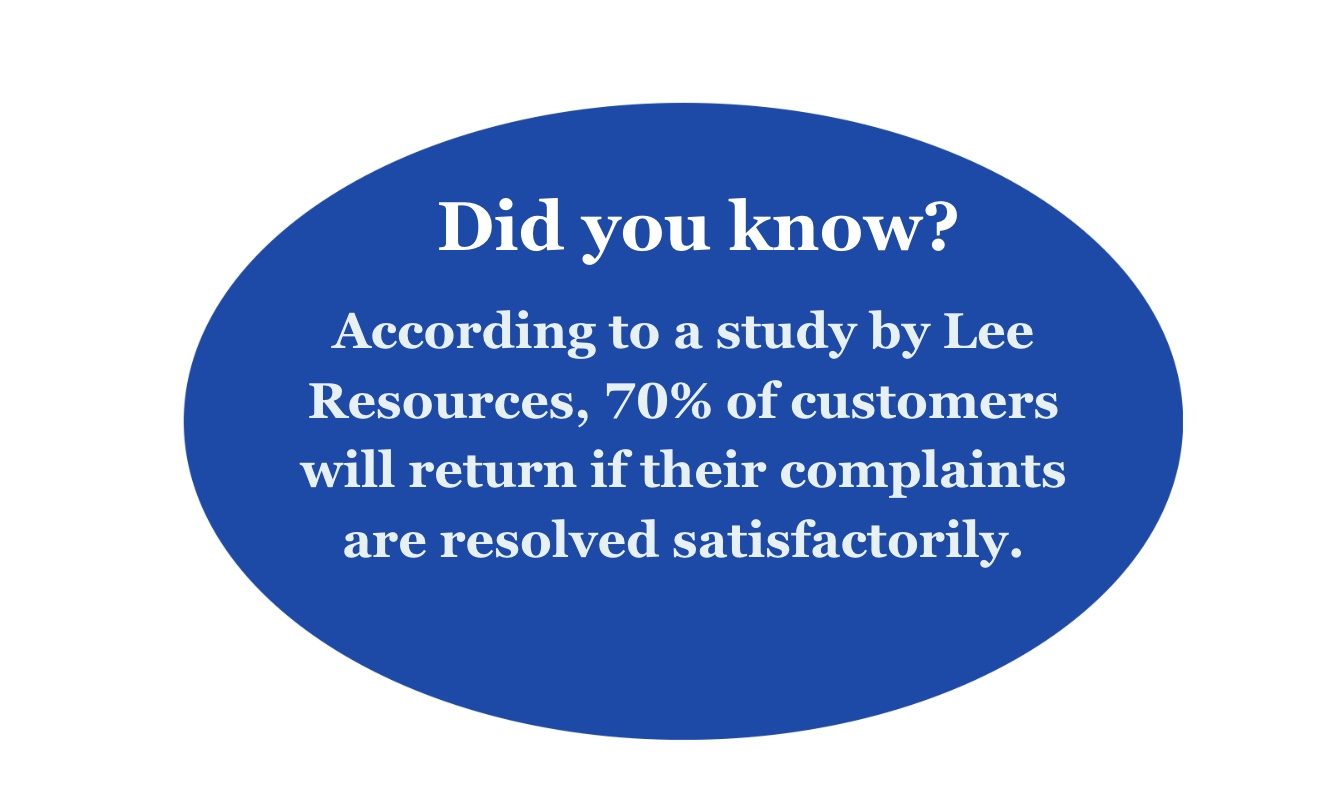

Handling Complaints

Address client complaints promptly and professionally. Have a clear policy for resolving disputes and ensure your team is trained to handle issues effectively.

Financial Management

Setting Fees

Determine your pricing structure. You might charge a flat fee, a monthly subscription, or a fee per deletion. Ensure your fees comply with CROA regulations. According to Credit Repair Cloud, the average credit repair company charges between $79 and $129 per month.

Budgeting and Forecasting

Create a detailed budget outlining your expected expenses and revenue. Regularly review your financial performance and adjust your budget as needed. A survey by QuickBooks found that 50% of small businesses use budgeting software to manage their finances effectively.

Accounting and Taxes

Use accounting software to manage your finances. Hire an accountant for tax preparation and ensure compliance with all tax laws.

Growing Your Business

Scaling Your Operations

As your business grows, you may need to expand your team, invest in additional software, and possibly open additional offices. Plan for growth by setting clear milestones and regularly reviewing your business plan. A report by the SBA found that businesses with growth plans are 30% more likely to succeed.

Diversifying Your Services

Consider adding new services to attract more clients and increase revenue. This might include credit building programs, identity theft protection, or small business credit consulting. According to Experian, businesses that offer a variety of services see higher client retention rates.

Continuous Improvement

Stay updated with industry trends and continuously seek ways to improve your services. Solicit feedback from your clients and make adjustments based on their input. You can also share credit repair software resources on your website to add value to your product. A study by Gallup found that businesses that actively seek and use customer feedback outperform their competitors by 25%.

Conclusion

Starting a credit repair business requires careful planning, dedication, and a commitment to helping others.

By following this comprehensive guide, you can build a successful credit repair business that not only helps clients improve their financial health but also achieves your entrepreneurial goals.