How to Increase Your Credit Score by 100 Points in 90 Days (Step-by-Step Guide)

This post will show you how to increase your credit score by 100 points in just 90 days.

(Step-by-step.)

Our team has helped hundreds of clients improve their credit scores using these exact strategies. In fact, most of our clients see a 50-100 point increase within 90 days.

Plus: This strategy has helped our clients qualify for lower interest rates, better credit card offers, and even secure mortgage approvals.

And most importantly: We’ve consistently seen a 70% success rate for clients who follow this method precisely.

You’re about to learn exactly how to boost your credit score quickly and effectively.

Step #1: Break Down Your Credit Repair Process Into Small Steps

Step #2: Get Your Credit Report Organized

Step #3: Plan Out Your Credit Repair Steps for the Next 90 Days

Step #4: Focus on Reducing Credit Card Balances

Step #5: Dispute Errors on Your Credit Report

Step #6: Avoid Opening New Credit Accounts

Step #7: Make On-Time Payments Every Month

Step #8: Track Your Progress

Step #9: Continuously Improve and Stay Consistent

Conclusion: Start Increasing Your Credit Score Today

Step #1: Break Down Your Credit Repair Process Into Small Steps

It’s tempting to think that “improving your credit score” is a single action. In reality, it involves multiple small steps.

If you try to tackle everything at once, you’ll feel overwhelmed. Worse, you might miss critical details that could fast-track your credit boost.

In the beginning, most people manage their credit repair on their own, taking small actions like paying down a credit card balance here or disputing an error there.

And that can work – for a while.

But if you’re looking to make big gains in a short period, you need a system. One that focuses on all the areas affecting your score.

In other words:

You should prioritize what you’re good at (like making payments on time). And get help for the tasks that are less straightforward (such as disputing inaccurate items or negotiating with creditors).

This approach takes your credit repair process from disorganized guesswork:

To a system that works.

By breaking down the process into clear steps, you’ll be able to increase your credit score steadily.

And you’ll see real results without getting overwhelmed.

Step #2: Get Your Credit Report Organized

The first thing you need is a detailed look at your credit report. It’s impossible to improve your credit score if you don’t know what’s affecting it.

(And this is especially important if you want to boost your score by a significant amount, like 100 points.)

Get a free credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. You can also get it from third-party providers like, IdentityIQ. Once you have your reports, go over them line by line.

Make sure to look for:

Inaccurate information: This could be a payment marked late when you paid on time, accounts that aren’t yours, or balances that are incorrect.

Negative items: Identify any collections, charge-offs, or late payments.

Credit utilization: See if any credit cards are maxed out or close to their limit.

Once you have all this information, you can start taking action. The most effective way to stay on top of these steps is to create a checklist.

For example, here’s how we organize our credit repair process:

Dispute inaccuracies

Pay down high balances

Request credit limit increases

This level of organization ensures you don’t miss any opportunities to improve your score.

Step #3: Plan Out Your Credit Repair Steps for the Next 90 Days

Now that you have your credit report and a clear understanding of what’s dragging down your score, it’s time to map out your plan for the next three months.

In the past, people would only focus on one or two strategies at a time, like disputing errors or making on-time payments.

But our approach involves addressing all areas that impact your score – simultaneously.

We’ve found that a well-structured plan can help people see a 50-point improvement in the first 30 days, and an additional 50-point boost over the next 60 days.

Here’s a sample 90-day plan:

Day 1-7: Dispute inaccuracies

File disputes with all three bureaus for any incorrect items on your report. Disputes take about 30 days to process, so start early.Day 8-30: Pay down balances

Focus on paying down any credit card balances that are close to the limit. Your credit utilization ratio is one of the biggest factors affecting your score.Day 31-60: Ask for credit line increases

If you can’t pay down balances quickly, request credit limit increases. This will improve your credit utilization ratio instantly, even if your balance stays the same.Day 61-90: Add positive credit history

If possible, become an authorized user on a family member’s account with a long, positive history. This can increase your score by 30-50 points within a few weeks.

Mapping out these steps in advance helps you stay focused, organized, and stress-free throughout the process.

Step #4: Focus on Reducing Credit Card Balances

Paying off credit card debt is one of the most effective ways to boost your credit score quickly.

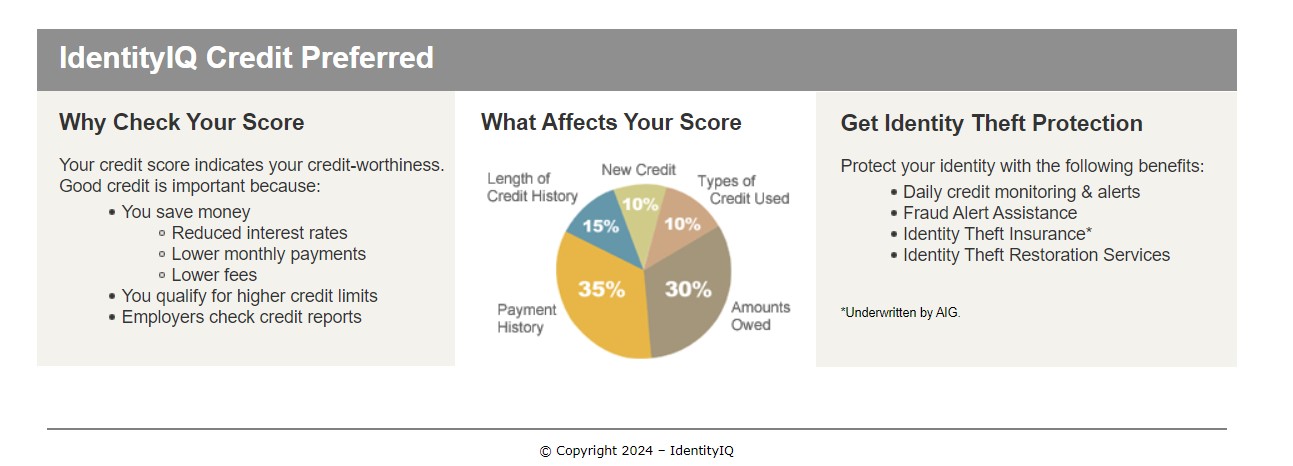

Here’s why: 30% of your FICO score comes from your credit utilization ratio (how much credit you’re using compared to how much you have available). A high utilization rate can be a huge drag on your score.

For example, if you have a credit limit of $5,000 and you’re using $4,000 of that, your utilization rate is 80%. This can lower your score by 50-100 points. To see a noticeable score increase, you should aim to keep your utilization below 30%.

Here’s how to prioritize reducing your credit card balances:

Target High-Interest Balances First

Make a list of all your credit cards and sort them by their interest rates. Focus on paying down the highest-interest cards first. This will save you money in the long run and help you reduce your balances faster.

Pay More Than the Minimum Payment

If you’re only paying the minimum on your credit cards, it will take much longer to see a significant score improvement. Whenever possible, pay more than the minimum. Even an extra $50-$100 a month can make a big difference.

Consider a Balance Transfer

If you have good enough credit, you may qualify for a balance transfer card with 0% interest for the first 12-18 months. This can help you pay off debt faster without racking up additional interest.

By reducing your credit card balances, you’ll see a direct improvement in your credit score—and you could be well on your way to hitting that 100-point goal in 90 days.

Step #5: Dispute Errors on Your Credit Report

Did you know that one in five Americans has an error on their credit report? And these errors can drag down your score by 100 points or more.

That’s why disputing inaccuracies is one of the fastest ways to boost your score. When you successfully dispute an error, the negative information is removed from your report, which can lead to an immediate score increase.

Here’s how to effectively dispute errors:

Identify Errors on Your Credit Report

When you pull your credit report, carefully check for any inaccuracies. Common mistakes include:

Incorrect personal information (like your name or address).

Accounts that aren’t yours.

Late payments that you know were made on time.

Duplicate accounts.

File a Dispute With the Credit Bureaus

Once you’ve identified an error, you’ll need to file a dispute with the credit bureaus. You can do this online through each bureau’s website, by mail, or by phone.

When filing your dispute, include any supporting documentation (like bank statements or payment confirmations) to back up your claim.

Follow Up and Monitor the Results

After filing a dispute, the credit bureau has 30 days to investigate. During this time, make sure to keep an eye on your credit report to see if the error has been removed. If it hasn’t, follow up with the bureau to check the status of your dispute.

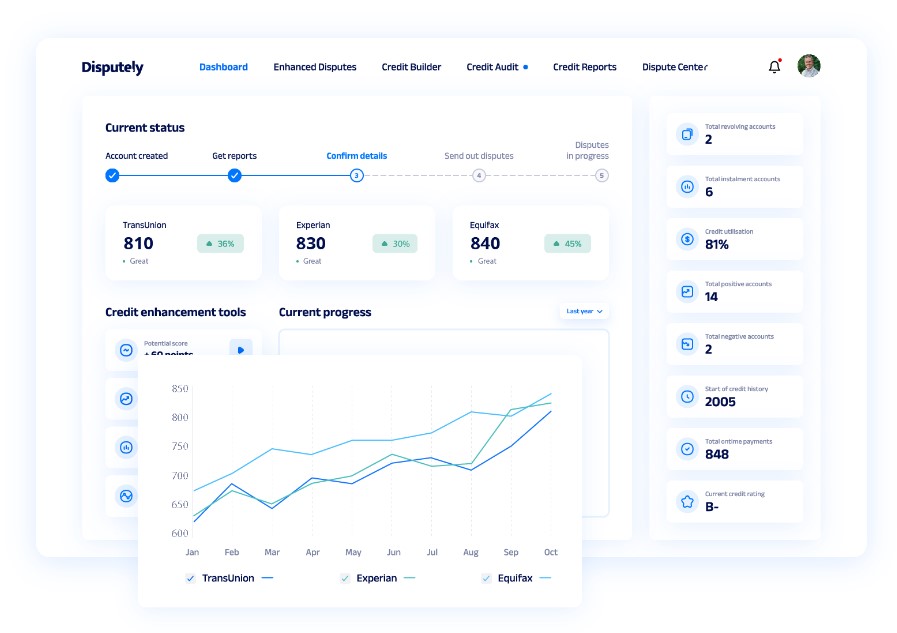

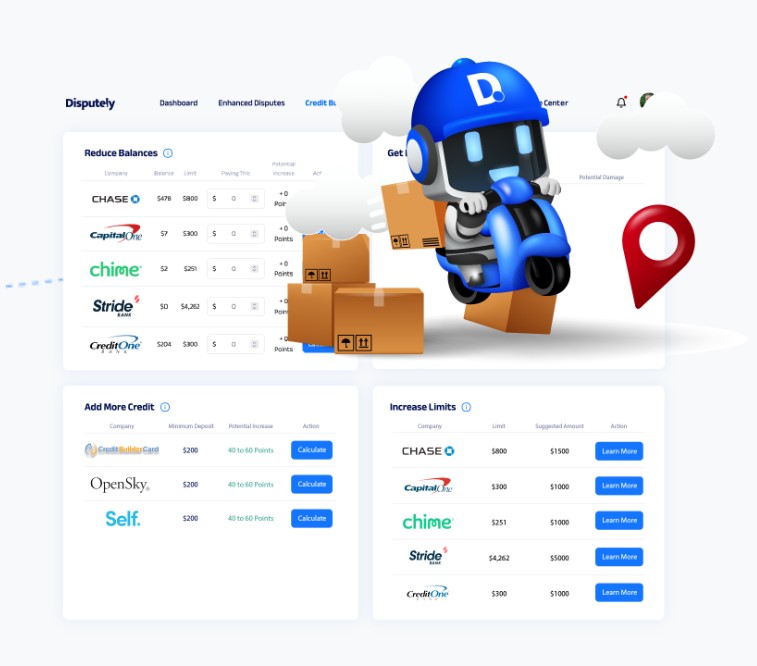

The best part? You can use a credit repair software like Disputely, to do all of these!

By removing inaccurate information from your report, you can see a quick jump in your credit score. In fact, some of our clients have seen increases of 50-100 points just by disputing errors!

Step #6: Avoid Opening New Credit Accounts

It may be tempting to open new credit accounts to improve your credit mix, but this can backfire. Every time you apply for credit, the lender runs a hard inquiry on your credit report. And hard inquiries can knock a few points off your score.

If you’re working on improving your credit, it’s best to avoid any unnecessary applications for new credit. Instead, focus on improving the accounts you already have.

Here’s why:

Hard Inquiries Can Lower Your Score

Each hard inquiry can drop your credit score by 5-10 points. And if you’re applying for multiple accounts in a short period of time, those points can add up quickly.

New Accounts Can Lower Your Average Age of Credit

The average age of your credit accounts makes up 15% of your FICO score. When you open a new account, it lowers the average age of your accounts, which can hurt your score.

Instead of opening new accounts, focus on maintaining and improving the accounts you already have. By doing this, you’ll avoid unnecessary score drops and keep your credit history intact.

Step #7: Make On-Time Payments Every Month

This step might sound obvious, but it’s one of the most important things you can do to boost your credit score.

35% of your FICO score comes from your payment history. Late or missed payments can cause your score to drop significantly—sometimes by 100 points or more.

Here’s how to ensure you never miss a payment:

Set Up Automatic Payments

The easiest way to make sure you’re never late on a payment is to set up auto-pay. This way, your payments are made on time every month, and you’ll never have to worry about missing a due date.

Set Payment Reminders

If you prefer not to use auto-pay, set reminders on your phone or calendar to alert you when a payment is due. This extra step can prevent any late payments from slipping through the cracks.

Pay at Least the Minimum

Even if you’re struggling to pay off large balances, make sure to pay at least the minimum amount due each month. Missing even one payment can have a big impact on your score.

Step #8: Track Your Progress

We mentioned this earlier, and this is very important to be consistent about.

Tracking your credit score over the next 90 days is key to seeing improvements. Without regular monitoring, you won’t know what’s working or if you need to adjust your strategy.

We recommend using a credit monitoring service that provides updates from all three bureaus.

This way, you’ll know if your disputes have been resolved, whether your credit utilization has improved, and when positive items have been added to your report.

By tracking your progress weekly, you can make adjustments to your plan in real time, ensuring you reach your goal of increasing your score by 100 points.

Step #9: Continuously Improve and Stay Consistent

Once you see your credit score increasing, it can be tempting to relax. But consistency is crucial.

Continue making on-time payments, keep your credit utilization low, and review your credit report for errors every few months.

With a strong plan in place, many people see their credit scores increase by 100 points in as little as 90 days.

Others may need a little more time, but the strategies remain the same.

The key takeaway? A credit score boost requires a clear plan, consistent effort, and regular monitoring. Follow these steps, and you’ll be well on your way to better credit in no time.

Conclusion: Start Increasing Your Credit Score Today

Improving your credit score by 100 points in 90 days might seems hard - at first. But with a clear plan, consistent action, and some patience, it’s absolutely possible.

By following the steps outlined above—creating an organized plan, reducing your credit card balances, disputing errors, avoiding new credit accounts, and making on-time payments—you’ll be on track to reach your goal in no time.

And remember: every small step you take today can lead to big improvements in your financial future.