How to Check Your Credit Report for Free: A Comprehensive Guide

Wondering how to check your credit score for free? Monitoring your credit score is crucial for staying on top of your financial health. It impacts your ability to secure loans, rent an apartment, or even get a job.

Fortunately, checking your credit score has become easier than ever. Many services now offer free credit report access for everyone.

In this guide, we'll show you exactly how to check your credit score for free, covering the best options available today.

By understanding where and how to access your credit score, you can stay on top of your financial health and take proactive steps to improve your credit profile.

Why Your Credit Score Matters

Before talking about those free options to check your credit report, it's important to understand why your credit score matters.

A credit score is a numerical representation of your creditworthiness. A credit rating ranges from 300 to 850 and the average credit score is anywhere between 700-770. The higher your score, the more attractive you are to lenders, landlords, and even potential employers.

Here’s how your credit score can affect different aspects of your life:

Loans and Credit Cards: A higher score can lead to better interest rates and loan terms.

Renting an Apartment: Landlords often check credit scores to gauge the reliability of potential tenants.

Employment: Some employers may review your credit score as part of the hiring process.

Understanding and regularly checking your credit score gives you the insight needed to make informed financial decisions. Let’s look at how you can access your credit score for free.

Where Can I See My Credit Report For Free

1. Credit Card Companies and Banks: A Perk of Membership

Do you have a credit card or bank account? If so, you might already have free access to your credit score. Many banks and credit card companies now offer free credit score monitoring as part of their customer perks. You can often view your score through their website or mobile app.

Some popular credit card issuers and banks that provide free credit score access include:

Chase: Provides free FICO® scores through the Chase Credit Journey portal.

Discover: Offers free FICO® scores to cardholders via their online account dashboard.

Bank of America: Includes FICO® score access as part of their online banking services.

Tip: Check with your financial institution to see if they offer free credit score access, and if so, make it a habit to monitor your score regularly. It’s a quick and easy way to keep tabs on your credit score without paying a fee.

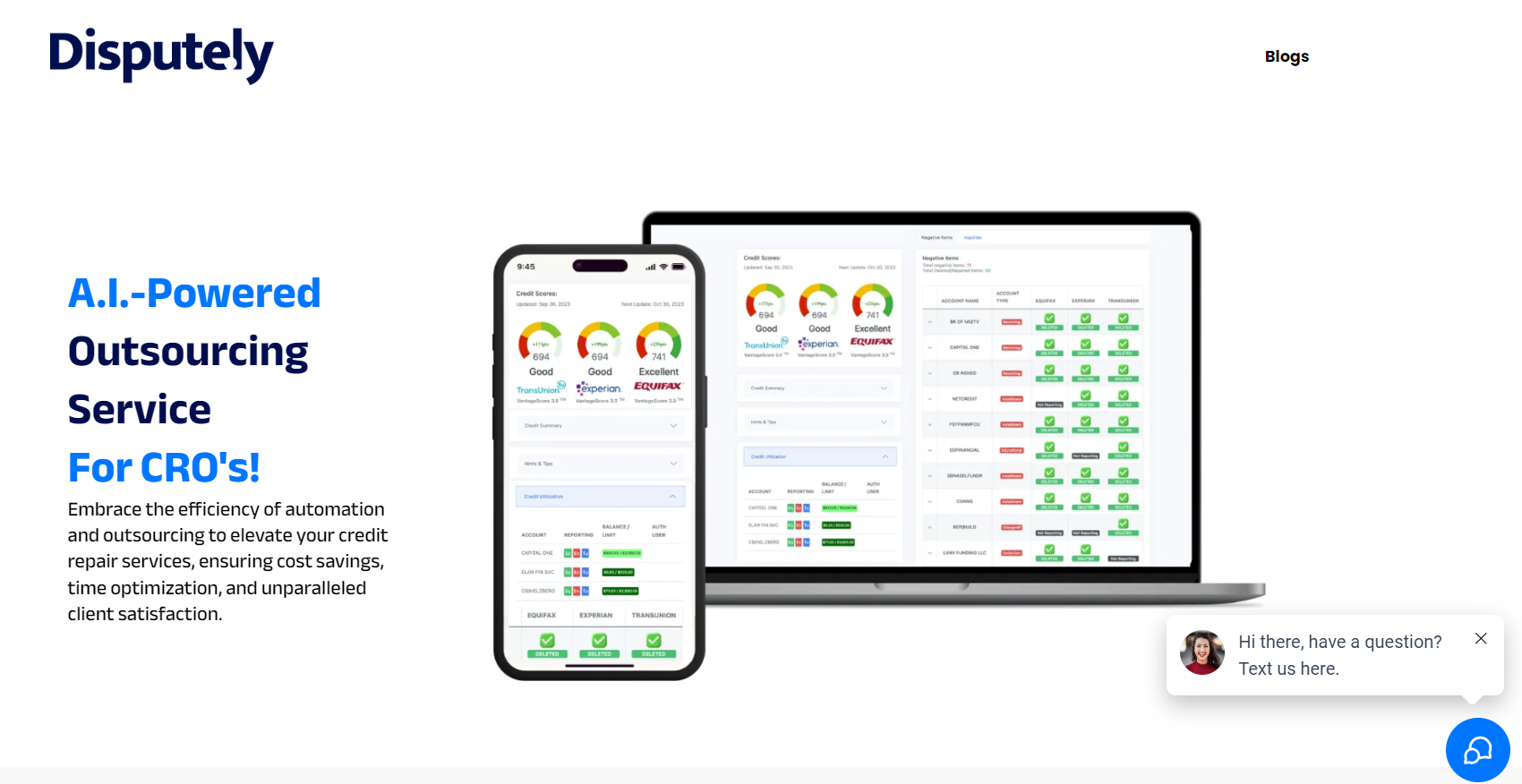

2. DisputelyAI: A Comprehensive Credit Management Tool

DisputelyAI is an innovative platform designed to help you take control of your credit. With DisputelyAI, you can monitor your credit score for free while also accessing a range of tools to manage and improve your credit profile.

Here’s what DisputelyAI offers:

Sign Up for Free Access

Start by visiting the DisputelyAI website and signing up for their free plan. Upon registration, you’ll gain access to essential credit management tools, including regular updates on your credit score and credit report.

Monthly Credit Score Updates

DisputelyAI provides free monthly credit score updates, allowing you to track your progress and identify areas that need improvement. These updates ensure you stay informed about any changes to your credit profile and take proactive steps to boost your score.

Credit Monitoring and Alerts

With DisputelyAI’s credit monitoring feature, you’ll receive alerts when significant changes occur in your credit report, such as new inquiries or changes in your credit utilization. This helps you stay on top of any unusual activity and protect your financial health from identity theft or fraud.

Credit Dispute Tools

If you find errors or discrepancies in your credit report, DisputelyAI offers easy-to-use tools to help you dispute inaccurate information. With step-by-step guidance, you can easily setup your credit repair software. This will make resolving credit issues quickl and effective, helping to boost your credit score over time.

3. IdentityIQ: Comprehensive Credit Monitoring

If you're serious about monitoring your credit, using a dedicated service like IdentityIQ is a smart move. Not only do they provide you with free access to your credit score, but they also offer credit reports from all three major bureaus: Experian, Equifax, and TransUnion. This gives you a complete view of your credit health.

With IdentityIQ, you’ll receive:

Real-Time Alerts: Get notified immediately if there's any suspicious activity on your account.

Monthly Credit Reports: Stay informed about any changes to your credit profile and take action as needed.

Score Tracking: Track your score over time and get advice on how to improve it.

How to Get Started:

Visit IdentityIQ’s website and sign up for their free trial.

Check your score and monitor any updates or changes that might affect your credit.

4. Free Credit Score Apps: Checking on the Go

For those who prefer checking their credit score on the go, several free credit score apps are available for download. These apps not only provide free access to your credit score but often come with additional features like credit monitoring, score simulators, and personalized recommendations for improving your score.

Some popular free credit score apps include:

Credit Karma: Offers free VantageScore® access, credit monitoring, and personalized recommendations.

Mint: A budgeting app that also provides free access to your credit score.

Experian: Provides free access to your FICO® score along with additional credit management tools.

These apps make it easy to stay on top of your credit score from anywhere and provide valuable insights into how your financial habits impact your credit.

5. AnnualCreditReport.com: Free Access to Your Credit Report

While checking your credit score is important, it’s equally vital to review your full credit report. Your credit report contains detailed information about your credit history, including account balances, payment history, and any outstanding debts.

Under federal law, you’re entitled to one free credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—every 12 months. During the COVID-19 pandemic, the bureaus began offering free weekly reports, which remain available through AnnualCreditReport.com.

Here’s how to access your credit report:

Visit AnnualCreditReport.com.

Select your preferred bureau (or request all three reports).

Follow the verification steps to confirm your identity.

Download and review your credit report.

By regularly reviewing your credit report, you can spot errors, identify opportunities to improve your score, and ensure your financial information is accurate.

Why You Should Check Your Credit Score Regularly

Regularly checking your credit score is one of the best ways to stay in control of your financial health. Here’s why:

Identify Errors: Credit reports can contain inaccuracies that negatively impact your score. Catching and disputing these errors early can prevent long-term damage.

Monitor Credit Usage: Keeping an eye on your credit utilization—how much of your available credit you're using—can help you make adjustments to improve your score.

Track Your Progress: Regular score checks allow you to monitor how your financial decisions affect your credit over time.

Make it a habit to check your credit score regularly. It’s one of the easiest ways to protect your financial health and make smarter money decisions.

Conclusion

With free resources available through credit card companies, banks, and platforms like DisputelyAI, there’s no excuse not to check your score regularly. By monitoring your score, reviewing your credit report, and taking proactive steps to improve your credit, you’ll be well on your way to securing better loan terms, lower interest rates, and more financial opportunities.

Start today with DisputelyAI and unlock the full potential of your credit.