Can I Get Approved for a Credit Card with a 600 Credit Score

Getting approved for a credit card with a 600 credit score is becoming more challenging than ever. But it’s not impossible.

Many financial institutions offer credit cards to applicants with credit scores of 600 or lower. While these cards often come with higher interest rates and fees, they provide an opportunity to build or rebuild your credit. Some issuers even offer quick approval and funding processes.

So, to answer your question, can I get approved for a credit card with a 600 credit score? Absolutely!

A 600 credit score falls into the "fair" category, which means you might face some limitations but still have viable options. This guide will provide detailed insights into how you can get approved for a credit card with a 600 credit score.

We’ll also touch base on the types of credit cards available, and strategies to improve your chances of approval.

Understanding Credit Scores and Their Impact

Is 600 an acceptable credit score?

A 600 credit score is a bit of a mixed bag. On one hand, you're likely to be approved for some credit cards, especially those designed for people with fair or average credit. On the other hand, you may face higher interest rates, lower credit limits, and fewer rewards compared to cards designed for people with excellent credit.

Common Causes of a 600 Credit Score:

Missed or late payments: Even a few late payments can significantly impact your score.

High credit utilization: If you've maxed out your credit cards or consistently carry high balances, your score may be lower.

Limited credit history: If you haven't had credit for long, your score might be lower due to a lack of history.

Derogatory marks: Things like collections, charge-offs, or bankruptcies on your credit report can also drag your score down, making it harder to qualify for premium credit products.

Knowing what factors are influencing your credit score can help you take steps to improve it over time.

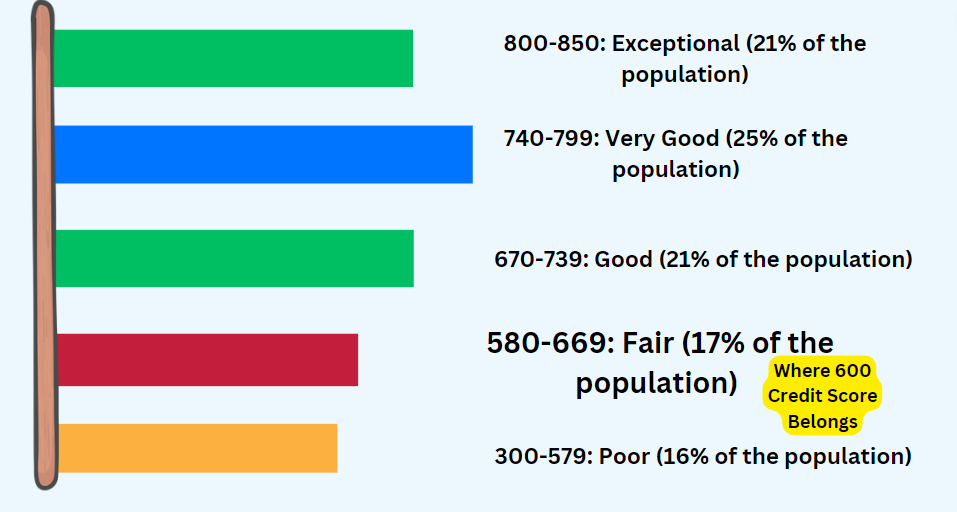

Credit Score Ranges

Credit scores are categorized into five main ranges. A credit score is scaling your creditworthiness, ranging from 300 to 850. It is calculated based on your credit footprint. This includes your payment history and the amount of debt you owe.

It also considers the length of your credit history and the types of credit accounts you have. Additionally, recent credit inquiries are taken into account.

With a 600 credit score, you fall into the second-to-bottom tier, which is still considered a fair score. While this isn't the ideal range, it does not mean you are completely shut out from obtaining a credit card.

The most commonly used credit scoring models are FICO and VantageScore.

Here are the general categories and their corresponding percentages of the population:

300-579: Poor (16% of the population)

580-669: Fair (17% of the population)

670-739: Good (21% of the population)

740-799: Very Good (25% of the population)

800-850: Exceptional (21% of the population)

Note: These percentages are averages and may vary based on different data sources and specific populations.

How Credit Scores Affect Credit Card Approval

Criteria Used by Credit Card Issuers

What is the minimum credit score for a credit card? Banks and credit card issuers evaluate several factors when deciding whether to approve an application. Below are some:

Credit Score

Remember that this three-digit number is crucial. Generally, if you have a 400 credit score, it shows you are in a bad financial state. Whilst a 720 credit scores is considered good and those above 750 are excellent.

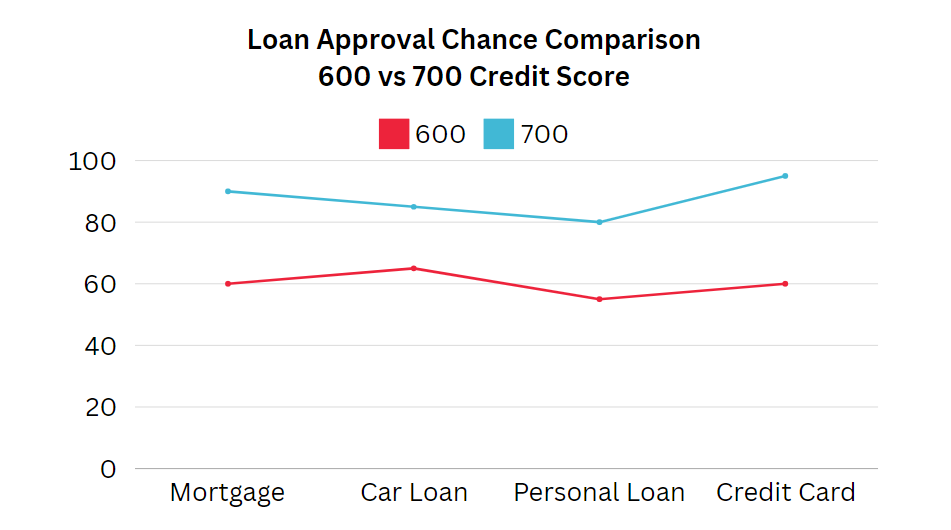

If you are in the 600 range, they see you as fair, but you won’t get the best card offer. Higher scores not only increase approval odds but also often lead to more favorable terms. These are such as lower interest rates and higher credit limits.

Income

Lenders seek assurance of your ability to meet financial obligations. A stable, verifiable income source is essential. A long-term employment is a positive factor.

While a high income isn't always necessary, it should be proportional with the card's requirements.

Tip: Include all legal income sources on your application.

Debt-to-Income Ratio

This metric compares your monthly debt payments to your gross monthly income. Ideally, keep your DTI below 36%. A lower ratio suggests better financial health and capacity to take on new credit.

Credit History and Utilization

Beyond your score, issuers scan your credit report. They look for:

Payment history (aim for 100% on-time payments)

Credit utilization ratio (keep it below 30% of your total available credit)

Length of credit history (longer histories are generally viewed more favorably)

Mix of credit types (demonstrating responsible management of various credit forms)

Recent Credit Inquiries

Multiple credit applications in a short period can be a red flag. Why? It’s because:

Applying for many cards at once can look bad

It might seem like you're desperate for credit

Try to space out your applications

Additional Factors

Some issuers consider factors like:

Existing relationship with the bank

Educational background

Residence stability

Pro Tip: Before applying, research the specific card's typical approval criteria. Some issuers provide pre-qualification tools that can give you an idea of your approval chances without affecting your credit score.

Remember, each issuer has its own algorithm for evaluating applications. By focusing on improving these key areas, you can enhance your overall creditworthiness and increase your chances of approval for the credit card that best suits your needs.

The Impact of a 600 Credit Score

So, Is a 600 credit limit good? Hmmm, to be honest. No. With a 600 credit score, you might encounter higher interest rates, lower credit limits, and fewer card options compared to someone with a higher score.

However, several types of credit cards are specifically designed for individuals in this credit range.

Types of Credit Cards Available for a 600 Credit Score

Secured Credit Cards

These are often available to individuals with very low credit scores or no credit history at all. There's usually no minimum credit score required, as approval is based on the applicant's ability to provide a security deposit.

How They Work: Secured credit cards are a common choice for individuals with lower credit scores. They require a security deposit, which typically acts as your credit limit. For example, if you provide a $500 deposit, that will usually be your credit limit.

Benefits: These cards are easier to qualify for and can be a great tool for building or rebuilding credit. They report your payment activity to the credit bureaus, so responsible use can help improve your credit score.

Drawbacks: The main downside is the need for a security deposit, which might tie up funds you could use elsewhere. Additionally, secured cards often come with higher fees and limited rewards.

Unsecured Credit Cards for Fair Credit

There are also some unsecured credit cards for bad or Fair Credit. They are specifically designed for people with bad credit (scores below 580) or fair credit (scores between 580 and 669). The minimum credit score for these cards can range from around 550 to 600.

How They Work: Unlike secured cards, unsecured credit cards don’t require a deposit. These cards are designed for people with fair credit and may offer basic rewards or benefits.

Benefits: With no security deposit required, these cards are more convenient. Some of these cards may offer cashback rewards or other perks, though they tend to be modest.

Drawbacks: These cards usually come with higher interest rates and lower credit limits than those available to people with higher credit scores. It’s important to manage your spending and avoid carrying a balance to prevent costly interest charges.

Retail Store Credit Cards

How They Work: Retail store credit cards are issued by specific retailers and can typically only be used for purchases at that store or affiliated brands.

Benefits: These cards are often easier to qualify for, making them an accessible option for individuals with a 600 credit score. They might also offer special discounts or promotions for cardholders.

Drawbacks: Retail store cards usually come with high interest rates and limited use, which can be restrictive if you’re trying to build credit across different types of purchases. They may also tempt you into overspending at that particular store.

Credit Card Recommendations for a 600 Credit Score

Discover it® Secured Credit Card

This is our personal favorite because it offers great cash back rewards and no annual fee. You can earn 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases each quarter) and 1% on all other purchases. Plus, Discover matches all the cash back you’ve earned at the end of your first year.

What you need when you apply:

A security deposit of at least $200, which will be your credit limit.

Basic personal information, including your Social Security number and income details.

Discover reports your activity to all three major credit bureaus, helping you build your credit history.

Capital One Platinum Secured Credit Card

We recommend the Capital One Platinum Secured Credit Card because it offers flexibility and automatic credit line reviews. With a $0 annual fee, you can start with an initial credit line of $200 with deposits of $49, $99, or $200, based on your creditworthiness.

After just six months, you could be eligible for a higher credit line without an additional deposit.

What you need when you apply:

A refundable security deposit, which can be as low as $49.

Choose your own monthly due date to fit your schedule.

Regular income and personal information for the application.

Capital One also reports to all three major credit bureaus, aiding in your credit-building efforts.

OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card stands out because it doesn't require a credit check to apply, making it accessible to those with lower credit scores. With a $35 annual fee and a security deposit ranging from $200 to $3,000, you have control over your credit limit.

What you need when you apply:

Same as the other 2 cards, you will need a minimum security deposit. This is $200.

Basic personal and financial information.

No credit check means your credit score won’t be impacted by the application.

Research Insights

According to a 2023 study by the Consumer Financial Protection Bureau: 85% of consumers who opened a secured card and used it responsibly saw their credit scores improve within 6 months.

On average, secured cardholders who started with scores below 660 saw an increase of 24 points after one year of use

Remember, while secured cards can be helpful, they're not the only option. Some issuers offer unsecured cards for fair credit, and store credit cards may also be accessible. Always compare options and read the terms carefully before applying.

Steps to Improve Your Chances of Approval

When applying for a credit card with a 600 credit score, a strategic approach can increase your chances of approval. This will help you get the most out of your new credit card:

Step 1: Check Your Credit Report

Before applying, it's wise to check your credit report for any inaccuracies or errors. If you find any discrepancies, your credit repair info is invaluable.

Sometimes, incorrect information can lower your credit score unfairly. Disputing and correcting these errors can improve your score and your chances of being approved for a credit card.

Step 2: Research Your Options

Not all credit cards for fair credit are created equal. Some offer better terms, lower fees, or more favorable interest rates than others. Take the time to compare different options and look for cards that offer prequalification, which allows you to check your likelihood of approval without impacting your credit score.

Step 3: Reduce Your Debt

Paying down existing debt can improve your credit utilization ratio, which is a significant factor in your credit score. Aim to keep your credit utilization below 30% of your available credit.

Step 4: Make Timely Payments

Your payment history is the most crucial factor in your credit score. Ensure all your bills, including utilities and rent, are paid on time. Setting up automatic payments or reminders can help you avoid late payments.

Step 5: Avoid Multiple Credit Applications

Each time you apply for a credit card, the lender performs a hard inquiry on your credit report, which can temporarily lower your score. To minimize the impact, apply for one card at a time and focus on cards where you have a good chance of approval.

Step 6: Consider a Co-Signer or Authorized User

If you’re having trouble getting approved on your own, you might consider asking someone with a strong credit history to co-sign your application.

Alternatively, becoming an authorized user on someone else’s account can help you build credit without applying for a new card yourself. Just be sure the primary cardholder has a solid payment history, as their activity will affect your credit as well.

Making the Most of Your New Credit Card

Once you’ve been approved for a credit card, how you manage it will be crucial to your financial future. Here’s how to use your new card responsibly:

1. Pay Your Bills on Time, Every Time

Why It Matters: Your payment history is the most significant factor in your credit score. Even one late payment can have a significant impact, so it’s essential to pay at least the minimum amount due on time each month. Setting up automatic payments or reminders can help ensure you never miss a due date.

2. Keep Your Balances Low

Why It Matters: Credit utilization—the amount of your available credit you’re using—is another critical component of your credit score. Aim to keep your balance below 30% of your credit limit.

For example, if your credit limit is $1,000, try not to carry a balance higher than $300. Lower utilization is even better and can positively impact your score.

3. Avoid Unnecessary Debt

Why It Matters: It’s easy to rack up debt on a credit card, especially if you’re tempted by impulse purchases or the convenience of credit. However, carrying a high balance can lead to high-interest charges and make it harder to pay off your debt. Stick to a budget, use your card for planned purchases, and pay off your balance in full whenever possible.

4. Monitor Your Credit Regularly

Why It Matters: Keeping an eye on your credit score can help you track your progress and catch any potential issues early. Many credit card issuers offer free access to your credit score and other credit monitoring tools, which are valuable for staying informed.

Additionally, consider using an ai credit repair software like Disputely. This credit repair software not only monitors your credit but also helps identify and dispute any inaccuracies on your credit report that could be dragging your score down.

By combining regular monitoring with proactive credit repair, you can ensure that your credit report accurately reflects your financial behavior, making it easier to improve your score over time.

Looking Ahead: Building a Better Credit Future

By responsibly managing your new credit card, you can gradually improve your credit score. As your score rises, you’ll gain access to better credit products with lower interest rates, higher limits, and more rewards.

Next Steps:

Set Milestones: Create a plan to increase your credit score over the next year. Set specific, achievable goals, such as reaching a score of 650 or reducing your credit utilization to below 20%.

Upgrade When Appropriate: As your credit score improves, you may qualify for credit cards with better terms. Consider upgrading to a card with lower fees, better rewards, or a higher credit limit when you’re ready.

Building credit takes time and discipline, but with the right strategies, you can work your way up from a 600 credit score to a stronger financial position.

Remember, every responsible action you take now is an investment in your financial future.