How Long Can I Increase My Credit Score from 400 to 700

Raising a credit score from 400 to 700 is a challenging but achievable goal.

This feat requires dedication, patience, and a clear understanding of the factors that influence your credit score.

A credit score of 700 or above is generally considered good and can open up opportunities for better loan terms, credit cards, and even job prospects.

In this guide, we will explore realistic timelines, effective strategies, and practical steps you can take to improve your credit score.

Understanding Credit Scores

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, based on your credit history.

It ranges from 300 to 850, with higher scores indicating better credit.

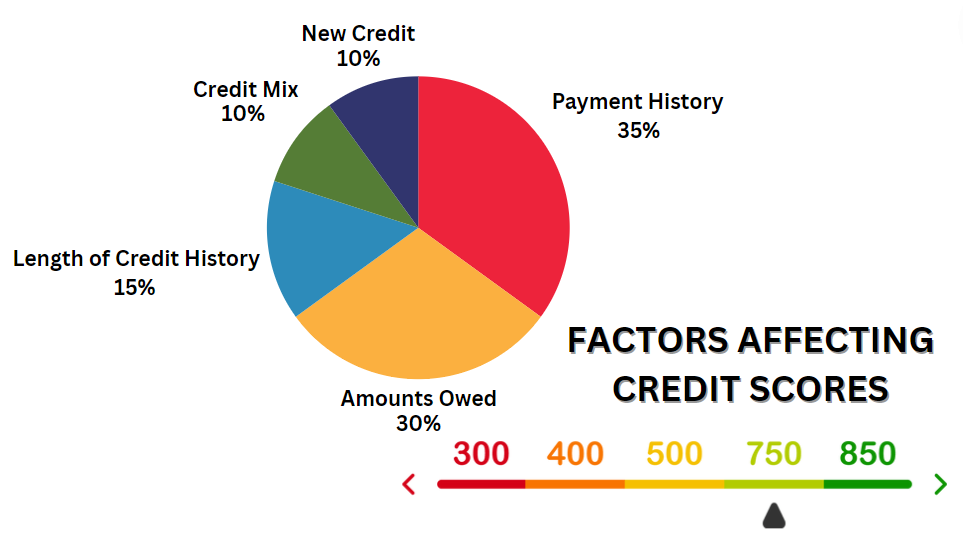

Various factors contribute to your credit score, including payment history, amounts owed, length of credit history, types of credit, and new credit inquiries.

Read here, why credit score is so important.

Factors Affecting Credit Score

Payment History (35%): Timely payments on loans and credit cards are crucial. Missed or late payments significantly impact your score.

Amounts Owed (30%): This refers to your credit utilization ratio – the amount of credit used compared to your total available credit. Keeping this ratio low is beneficial.

Length of Credit History (15%): The longer your credit history, the better. This includes the age of your oldest account, the average age of all your accounts, and the age of your newest account.

Credit Mix (10%): A mix of credit types (credit cards, retail accounts, installment loans, mortgage loans) can positively impact your score.

New Credit (10%): Frequent applications for new credit can negatively affect your score, as they suggest financial instability.

Setting Realistic Expectations

Starting Point: Credit Score of 400

A credit score of 400 is considered very poor, it’s much worse than having no credit score. It often results from severe issues like missed payments, defaults, bankruptcies, or high credit utilization.

Rebuilding from this point requires significant time and effort.

Target: Credit Score of 700

A credit score of 700 is considered good. Achieving this score indicates responsible credit management and can result in favorable terms for loans and credit cards.

Timeline Overview

Improving a credit score from 400 to 700 typically takes time. Depending on your individual circumstances, it can take anywhere from one to three years. Here’s a general timeline breakdown:

First 6 Months: Establishing good habits and stopping further damage.

6 to 12 Months: Seeing the first significant improvements.

1 to 2 Years: Consistent improvement with disciplined financial behavior.

2 to 3 Years: Achieving a score of 700 and maintaining it.

Detailed Timeline and Strategies

First 6 Months: Laying the Foundation

Assess Your Current Financial Situation

Check Your Credit Report: Obtain your credit report from the three major bureaus (Experian, Equifax, and TransUnion). Review it for accuracy and dispute any errors.

List Your Debts: Create a comprehensive list of all your outstanding debts, including the amounts owed, interest rates, and minimum payments.

Develop a Budget

Track Income and Expenses: Understand your monthly cash flow. Identify areas where you can cut back on non-essential expenses.

Prioritize Debt Repayment: Allocate funds to make at least the minimum payments on all your debts to avoid further damage to your credit score.

Make Timely Payments

Set Up Payment Reminders: Use calendar alerts, payment reminders, or automatic payments to ensure you don’t miss due dates.

Focus on Current Payments: Ensure all current payments are made on time to start rebuilding your payment history.

Reduce Credit Utilization

Pay Down Balances: Aim to reduce your credit card balances to lower your credit utilization ratio.

Avoid New Debt: Refrain from taking on new debt, as it can further strain your financial situation.

6 to 12 Months: Building Positive Credit History

Pay Off Debts Strategically

Snowball Method: Pay off the smallest debts first to gain momentum and motivation.

Avalanche Method: Pay off debts with the highest interest rates first to save money on interest over time.

Consider Debt Consolidation

Personal Loans: Consolidate high-interest debts into a single loan with a lower interest rate.

Balance Transfer Cards: Transfer high-interest credit card balances to a card with a lower interest rate or a promotional 0% APR period.

Use Secured Credit Cards

Apply for a Secured Credit Card: A secured credit card requires a security deposit that serves as your credit limit. It’s a useful tool for rebuilding credit.

Make Small Purchases: Use the card for small, manageable purchases and pay off the balance in full each month to build a positive payment history.

Monitor Your Credit Regularly

Track Progress: Regularly check your credit score with the help of credit repair automation. By doing this, you can easily track your progress.

Identify and Address Issues: Quickly address any new issues or inaccuracies on your credit report.

Dispute if needed: You can take advantage of technology or credit repair automation in doing disputes.

1 to 2 Years: Consistent Improvement

Diversify Your Credit Mix

Credit-Builder Loans: Consider taking out a small credit-builder loan, where the loan amount is held in a bank account while you make payments. Once the loan is paid off, the funds are released to you.

Become an Authorized User: Ask a trusted family member or friend to add you as an authorized user on their credit card. Ensure they have a good payment history, as this can positively impact your credit score.

Maintain Low Credit Utilization

Keep Balances Low: Aim to keep your credit utilization below 30% of your total available credit.

Request Credit Limit Increases: If you have been responsible with your credit, consider requesting a credit limit increase. This can help lower your credit utilization ratio.

Continue Making Timely Payments

Stay Disciplined: Continue making all payments on time. Consistency is key to improving your credit score.

Avoid New Hard Inquiries: Limit applications for new credit, as hard inquiries can temporarily lower your score.

2 to 3 Years: Achieving and Maintaining a Good Score

Review and Adjust Your Strategies

Assess Your Progress: Regularly review your credit report and score. Adjust your strategies based on your progress and any new financial goals.

Seek Professional Help: If needed, consult a credit counselor for personalized advice and strategies to improve your credit.

Keep Old Accounts Open

Length of Credit History: Keeping old accounts open can positively impact the length of your credit history.

Manage Accounts Responsibly: Use older accounts responsibly to continue building a positive credit history.

Stay Informed and Educated

Financial Literacy: Continuously educate yourself about personal finance, credit management, and debt repayment strategies.

Utilize Resources: Use books, online courses, and workshops to enhance your financial knowledge.

Practical Tips for Success

Stay Motivated

Set Milestones: Celebrate small victories, such as paying off a debt or seeing an improvement in your credit score.

Stay Focused: Keep your long-term goals in mind and stay committed to improving your financial health.

Seek Support

Talk to Others: Share your experiences with trusted friends or family members who can provide support and encouragement.

Join Groups: Consider joining support groups or online communities where you can share your journey and learn from others facing similar challenges.

Address Emotional and Psychological Challenges

Manage Stress: Financial struggles can be stressful. Practice stress-management techniques such as exercise, meditation, or seeking professional counseling.

Stay Positive: Focus on the progress you’re making and the positive changes you’re implementing in your financial life.

Patience and the Right Tools are Key

There's no magic bullet for raising your credit score from 400 to 700 overnight. It takes dedication, responsible financial behavior, and a bit of time.

However, with consistent effort and the right tools, you can achieve that excellent credit score and unlock a world of financial opportunities.

Here at Disputely, we understand that navigating the complexities of credit repair can be overwhelming. That's why we created Disputely a credit repair software powered by AI. Disputely helps you:

Identify and dispute errors: Our software scans your credit reports for inaccuracies that could be lowering your score. We guide you through the dispute process, making it easier to challenge these mistakes.

Track your progress: Monitor your credit score improvement over time and stay motivated on your journey to financial freedom.

Stay informed: Disputely provides educational resources and helpful tips to keep you informed about credit repair best practices.

Ready to take control of your credit and unlock a brighter financial future?

Visit Disputelyai.com today and start your free trial. Let Disputely be your partner in achieving a stellar credit score!