Why Was My Loan Application Denied

"Why was my loan application denied? Is that question bugging you too?"

You submitted your loan application, and you waited, fingers crossed, hoping for that approval. But then, you got the dreaded message: Denied.

I’ve been there, and I know how frustrating and confusing it can be. You did everything right—or so you thought—but the lender still said no.

Before we dive in, please understand that I’m sharing this information to empower you. While I’ve got years of experience in the financial space, I’m not your lender, and this isn’t official financial advice. Always consult with a financial advisor or your lender if you have specific questions about your situation.

Okay, here’s what happened…

A few years back, I applied for a loan that I really needed. I felt confident—my credit score wasn’t perfect, but I’d been working hard to improve it. I had a steady job, no massive debts, and I thought I’d done everything right. Guess what? Rejected.

I need money but can't get a loan. I was shocked and frustrated. I kept asking myself, “What did I miss?” I thought I was a good candidate, so the rejection hit hard. I went back through my application, checked my credit report again, and tried to figure out where things went wrong. It turned out that there were a few factors I hadn’t considered, things that the lender saw as red flags.

Now, after going through this process, I’m in a position to share some valuable insights with you. I want to help you understand why your loan application might have been denied, so you don’t have to go through the same stress and disappointment. And most importantly, I want to give you practical tips on how to improve your chances if you decide to apply again.

Okay, why do people not get approved for loans?…

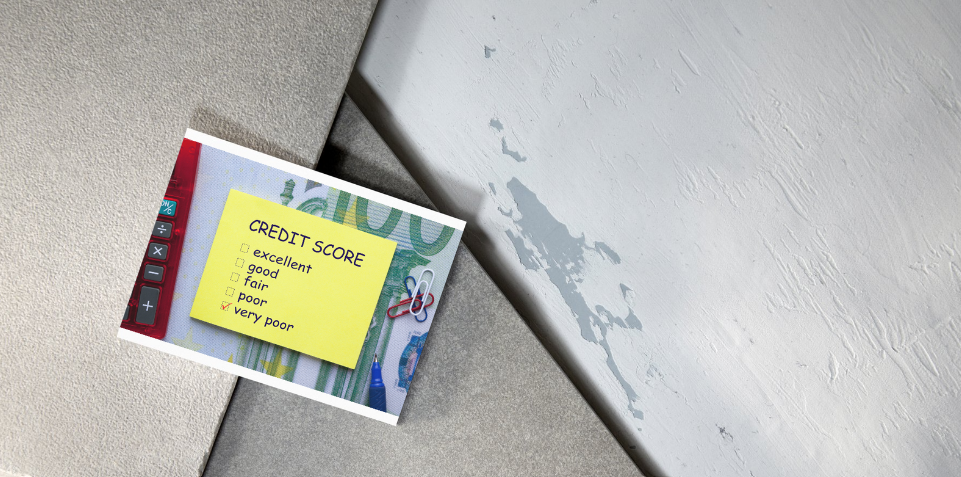

Reason #1: Your Credit Score Didn’t Make the Cut

Let’s face it—your credit score is the golden ticket in the world of loans. If your score isn’t up to par, lenders see you as a risky bet. And guess what? They don’t like taking risks with their money.

Your credit score is a reflection of your financial habits. Lenders use it to predict whether you’re likely to repay the loan. If your score is low, it raises red flags, signaling that you might struggle to meet the repayment terms.

What You Can Do:

Check for Errors: First, pull your credit report and scan it for any errors. Believe it or not, mistakes happen. Dispute anything that doesn’t look right. This is your first line of defense in boosting your score. If you saw a valid hit, better negotiate with your creditors.

Start Building Credit: Pay off outstanding debts, keep your credit card balances low, and make sure you’re paying your bills on time. Set up automatic payments to ensure you never miss a due date—payment history is the biggest factor in your score. Also, consider keeping old accounts open to maintain a longer credit history, which is another positive factor. These small steps can have a big impact over time.

Reason #2: Your Debt-to-Income Ratio Was Too High

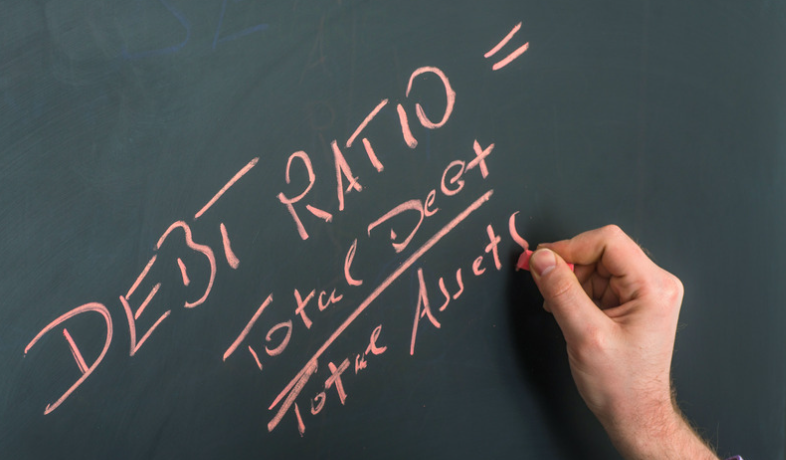

Here’s the deal—lenders don’t just want to see that you have money coming in; they want to know that you’re not already stretched too thin with other debts. That’s where your debt-to-income ratio (DTI) comes into play.

Remember, a high DTI ratio means you’re already juggling a lot of debt compared to your income. Lenders worry that adding more to your plate could tip the scales, making it harder for you to keep up with payments.

What You Can Do:

Pay Down Debt: Start tackling your highest-interest debts first. Not only will this lower your DTI, but it’ll also free up more of your income for other things—like that loan you’re trying to get.

Increase Your Income: Easier said than done, I know. But if there’s an opportunity to pick up extra work, a side gig, or even ask for a raise, now might be the time to explore those options.

Reason #3: Insufficient Income

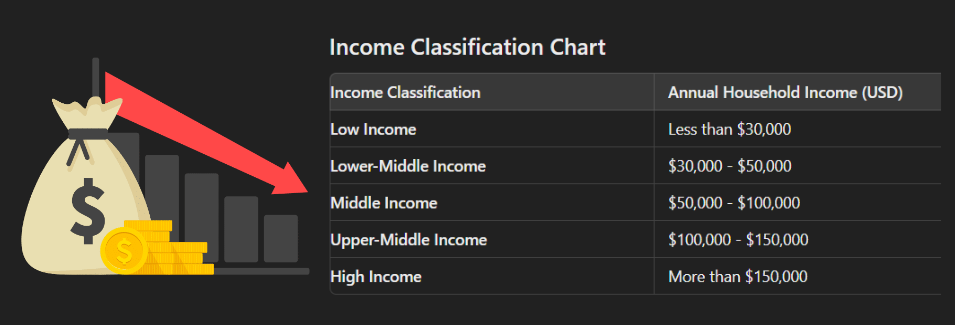

You might have a decent credit score and a manageable DTI ratio, but if your income doesn’t meet the lender’s criteria, you could still get denied.

When it comes to personal loan rejection reasons, lenders aren’t just looking at the numbers—they’re looking at the big picture. They need to be confident that you have enough steady income to cover the loan payments, on top of your other financial responsibilities. If your income is too low, even with a 720 credit score might not be enough to get that loan approved.

What You Can Do:

Reassess Your Loan Amount: Sometimes, it’s not about getting denied—it’s about asking for too much. Consider applying for a smaller loan that’s more in line with your current income level.

Provide Additional Documentation: If you have other sources of income—like freelance work, investments, or even financial support from a partner—make sure to document it and share it with your lender. Every bit helps.

Strengthen Your Application with a Co-Signer: If your credit or income isn’t quite where it needs to be, bringing in a co-signer with better financial credentials can help. A co-signer agrees to take on responsibility for the loan if you default, which reduces the lender’s risk. Just make sure your co-signer understands the risks and responsibilities involved.

So, you see, even with low income, you can still get approved for a loan. Consider ways to present a stronger financial profile to your lender. This could involve showing additional sources of income, such as side jobs, freelance work, or even investment income. The more stable and diversified your income sources, the more attractive you’ll be to lenders.

Reason #4: Recent Changes to Your Financial Situation

Let’s say you’ve recently switched jobs, started a business, or even gone through a major life event like a divorce. Lenders get nervous about big changes because they like stability.

Why It Matters: Lenders prefer borrowers who have a steady financial history. If your financial situation has recently changed, they might worry about your ability to handle new debt.

What You Can Do:

Wait It Out: If you’ve just started a new job or made a big financial move, consider waiting a few months before reapplying. Stability is key.

Offer a Bigger Down Payment: Sometimes, showing you’re willing to put more money down can ease a lender’s concerns. It shows that you’re serious and have a financial cushion.

Reason #5: Incomplete or Inaccurate Application

This might seem like a no-brainer, but you’d be surprised how often loan applications get denied because of simple mistakes—like missing information or inaccurate details.

Why It Matters: Even small errors can cause big problems. Lenders rely on the information you provide to make their decisions. If something doesn’t add up, they might deny your application outright.

What You Can Do:

Double-Check Everything: Before hitting submit, go over your application with a fine-tooth comb. Make sure all the information is accurate and complete. This is your one chance to make a good impression.

Provide Supporting Documents: If there’s anything unusual about your financial situation, explain it upfront and provide documentation. This can prevent misunderstandings and strengthen your case.

What to Do If You Keep Getting Rejected for Loans

Getting denied once is tough, but repeated rejections can feel like a punch to the gut. It’s easy to feel discouraged, but remember—you’re not alone, and this isn’t the end of the road.

After I dug deeper into why I was denied, I started exploring other options. There are alternative lenders out there who might be more willing to work with your specific situation. Maybe you don’t fit the strict criteria of a traditional bank, but that doesn’t mean you’re out of options.

So, what should you do if you keep getting turned down for loans? Let’s break it down.

Reapply When You’re Ready

First things first: don’t rush. Take a step back and reassess your situation. What’s holding you back? Is it your credit score? Your debt-to-income ratio? Or maybe your income? Whatever it is, take the time to address it.

Here’s the plan:

Improve Your Credit Score: If your score isn’t where it needs to be, work on boosting it. Pay down any outstanding debts, keep those credit card balances low, and always pay your bills on time. Even a few months of diligent effort can make a big difference.

Lower Your DTI: If your debt is too high, focus on paying it down. Start with the highest-interest debts first and work your way down. This will not only lower your DTI but also make you a more attractive borrower.

Increase Your Income: It’s easier said than done, but consider taking on a side gig or asking for a raise at work. Every little bit helps, and showing a higher income can improve your chances the next time you apply.

Once you’ve made these improvements, you’ll be in a much stronger position. Reapply when you’re ready, not when you’re frustrated. This time, go in with confidence, knowing you’ve done the work.

Explore Alternative Lenders

If traditional banks keep saying no, it might be time to think outside the box. “Who will give me a loan when no one else will?”

Credit unions, online lenders, and peer-to-peer lending platforms might be more open to working with you, even if your financial profile isn’t perfect. They often have different criteria and can offer more flexibility. Let’s take a closer look:

Credit Unions

These member-owned institutions often have more lenient lending requirements and can be more willing to work with you, especially if you’ve been a member for a while. Interest rates at credit unions tend to be lower than those offered by traditional banks, typically ranging from 5% to 18% for personal loans, depending on your credit score and the specific credit union. The loan terms can vary but usually range from 1 to 5 years.

Online Lenders

There are plenty of reputable online lenders who specialize in working with borrowers who might not have perfect credit. They often offer more flexible terms and quicker approval times, making them a good option if you need funds quickly. However, interest rates can be higher, ranging from 6% to 36% depending on your creditworthiness. Some online lenders may even offer prequalification, allowing you to check your rates without affecting your credit score. Loan terms generally range from 2 to 7 years.

Peer-to-Peer Lending

This is another option where individuals lend money to borrowers through online platforms. The requirements can be more relaxed, but interest rates tend to vary widely, often falling between 7% and 35%. While these rates can be high, especially for those with lower credit scores, peer-to-peer platforms can be more willing to take a chance on borrowers who might not qualify elsewhere. Loan terms usually range from 3 to 5 years.

When considering these alternative lenders, it’s crucial to look beyond the interest rate. Pay attention to fees, repayment terms, and the overall cost of the loan. Always do your homework—read reviews, check the lender’s reputation, and ensure that you’re getting the best deal for your situation.

Loan Declined? When Can I Apply Again?

As for when you should reapply, here’s the general rule of thumb: wait at least 3 to 6 months before applying again. This gives you enough time to make meaningful improvements to your financial profile and increase your chances of approval. Some lenders might even have specific waiting periods, so check with them if you’re unsure.

Takeaway

There you have it—the five most common reasons why your loan application might have been denied. But don’t lose hope! Each of these issues can be addressed with a little effort and the right strategy. Remember, understanding why you were denied is the first step toward turning that “no” into a “yes.”

If your credit score is holding you back, tools like Disputely credit repair software can be a game-changer. Disputely helps you identify and dispute errors on your credit report, streamlining the process and giving you a clearer path to improving your credit score. By taking control of your credit, you’re putting yourself in a better position for future loan approvals.

If you found this helpful, be sure to subscribe for more tips and insights on navigating the world of personal finance. We’re here to help you take control of your financial future!

Stay determined and keep pushing forward.