Why Quality Credit Repair Software Drives Business Growth in 2024

Why is Credit Repair Software Important?

Credit is everywhere—it’s the score on your credit report. Imagine being able to confidently apply for a loan. Or else, rent your dream house, or secure that job you've always wanted. All of this hinges on one crucial factor: your credit score

Your credit score affects your financial stability. It helps you build opportunities and interact with the market.

In a way, credit repair software is the backbone of the credit repair industry. It's the tool you use to show clients your services. It explains why they should choose you over a competitor. Without efficient credit repair software, you miss out on getting your ideal customer's attention.

However, not all credit repair software is created equal. You must have a keen eye to legit credit repair software. Spending in the wrong software can lead to wasted time, money, and effort.

To get the most benefits, you need a complete, easy-to-use solution. It should provide useful insights and support business growth.

In 2024, utilizing the right credit repair software is not just helpful—it’s critical.

Here are three reasons why credit repair software is essential for business growth in 2024.

We’ll also share a simple 5-step process to get started.

1. Credit Repair Software Enhances Efficiency and Accuracy

One of the most important aspects of credit repair is accuracy. Errors in disputing correct information can lead to delays or even worsening credit scores. Credit repair software automates much of the dispute process, ensuring accuracy and efficiency.

Good credit repair software helps manage many clients easily. It tracks each client's progress and provides quick updates. This order improves effectiveness and builds client trust. They see steady, correct results.

In addition to improving accuracy, credit repair software streamlines many time-consuming tasks. Automating tasks like creating dispute letters, tracking credit bureau responses, and managing client communications saves time. Business owners can then focus on growth and getting new clients.

How to Leverage Credit Repair Software for Enhanced Efficiency:

Automate Routine Tasks: Use the software to handle repetitive tasks like dispute generation and progress tracking.

Maintain Accurate Records: Ensure all client information is up-to-date and easily accessible.

Utilize Built-In Analytics: Leverage the software’s analytics to identify areas for improvement and track overall performance.

2. Credit Repair Software Improves Client Satisfaction and Retention

Client satisfaction has a huge impact on the growth of any business, and the credit repair industry is no exception. Satisfied clients are more likely to refer others to your services, leading to organic growth through word-of-mouth.

Credit repair software improves client satisfaction by providing a transparent and user-friendly experience. Clients can easily access their progress reports, understand the status of their disputes, and communicate with their service provider through the software. This clarity builds trust and confidence in your services.

Additionally, a streamlined process ensures quicker results. When clients see faster improvements in their credit scores, their satisfaction increases, leading to higher retention rates.

A happy client is a loyal client, and loyalty translates to long-term business growth.

How to Boost Client Satisfaction with Credit Repair Software:

Provide Transparent Progress Reports: Use the software to generate detailed reports that clients can access at any time.

Facilitate Easy Communication: Ensure clients can easily reach out to you through the software for any questions or concerns.

Showcase Quick Results: Highlight the speed and efficiency of your services through regular updates and success stories.

3. Credit Repair Software is Cost-Effective

Using credit repair software is a cost-effective solution that can save your business money in the long run. By automating many aspects of the credit repair process, you reduce the need for extensive manual labor, allowing your team to focus on more strategic initiatives.

Moreover, the accuracy and efficiency provided by the software minimize the risk of costly errors and disputes. Investing in a robust credit repair software solution can lead to significant savings on operational costs while boosting your overall revenue through improved client satisfaction and holding.

How to Maximize Cost-Effectiveness with Credit Repair Software:

Invest in Comprehensive Solutions: Choose software that offers a wide range of features to avoid additional expenses on multiple tools.

Train Your Team Efficiently: Ensure your team is well-trained on how to use the software to get the most out of its benefits.

Monitor ROI: Regularly track the return on investment from the software to ensure it continues to meet your business needs.

5 Steps to Get Started with Credit Repair Software

If you want to become a credit repair specialist, you need the right tools to get you started.

Having a reliable dispute software tool is one of them. Technology can be overwhelming in the beginning, but believe me - it will all come handy in the long run.

So, how to use a credit repair software?

Credit repair software is relatively simple to get started with, but a solid process makes achieving results much more reliable. Your credit repair software should serve your business objectives, which should align with your overall strategy.

Step 1: Define Your Goals and Target Audience

What does success look like to you?

Set clear goals that align with your business strategy. These goals might include:

Increase in Client Acquisition: Aim for a specific percentage increase in new clients each quarter.

Enhanced Client Retention: Target a lower churn rate by improving client satisfaction.

Revenue Growth: Set milestones for revenue made through credit repair services.

Step 2: Research and Select the Right Software

Choosing the right credit repair software can make or break your business. Research different options, compare features, and select a solution that fits your business needs. Consider factors such as:

Ease of Use: The software should be user-friendly for both your team and your clients.

Comprehensive Features: Look for software that offers all the necessary tools for dispute management, progress tracking, and client communication.

Scalability: Ensure the software can grow with your business.

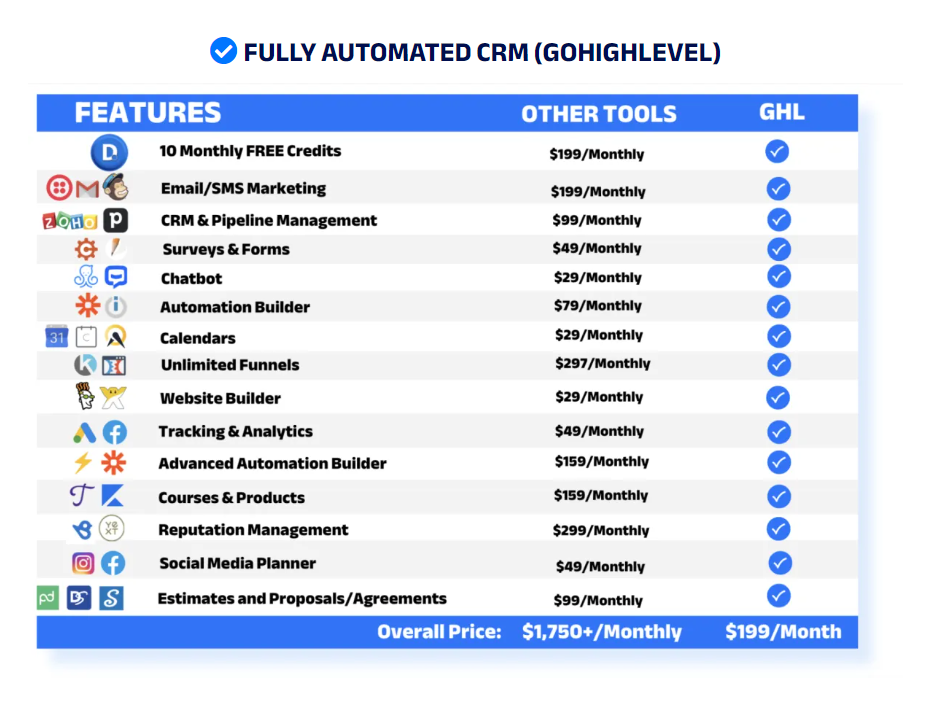

Here's a comparative display of Disputely's features Vs. Others

Step 3: Implement and Train Your Team

Once you’ve selected your software, implement it into your daily operations and train your team on how to use it effectively.

1. Plan the Implementation

First, create a plan for how you will introduce the new software into your daily operations. This plan should include:

A timeline for each stage of the implementation

Specific tasks that need to be completed

Who is responsible for each task

2. Set Up the Software

Next, set up the software. This involves:

Installing the software on all necessary devices

Setting up user accounts for each team member

Configuring the software to match your business needs

3. Conduct Training Sessions

Hold training sessions to teach your team how to use the software. During these sessions:

Demonstrate how to perform key tasks

Allow team members to practice using the software

Answer any questions they may have

4. Provide Ongoing Support

After the initial training, continue to support your team by:

Offering refresher courses

Providing access to training materials

Being available to answer questions and troubleshoot issues

5. Monitor and Evaluate

Finally, monitor how well your team is using the software. Check if they are:

Completing tasks correctly

Finding the software easy to use

Meeting performance goals

Complete training makes sure everyone understands and can fully use the software.

Step 4: Promote and Distribute Your Services

Promote your credit repair services through various channels to reach your target audience. Utilize social media, email marketing, and your website to highlight the benefits of your services and the advanced technology you use.

Step 5: Measure, Analyze, and Optimize

Regularly measure the performance of your credit repair software. Use analytics tools to track key metrics such as client obtaining, retention rates, and overall satisfaction. Analyze the data to identify areas for improvement and optimize your processes accordingly.

Key Features of Effective Credit Repair Software

Now that you have a solid plan for getting started with credit repair software, it's important to understand the key features that make this software effective.

By knowing what to look for, you can select a solution that best supports your business goals and boosts your clients' experience.

1. Automated Dispute Management

Automating the dispute process can save a lot of time and effort. Good credit repair software generates, sends, and tracks dispute letters automatically. This automation can reduce manual errors by up to 40% and ensures that disputes are handled quickly and accurately.

2. Client Management System

An integrated client management system helps you keep track of all your clients in one place.

This feature should include:

Detailed client profiles

Progress tracking

Notes and reminders

Having all client information readily accessible can increase efficiency by up to 30%, allowing you to provide personalized and attentive service.

3. Progress Tracking and Reporting

Transparency is key to client satisfaction. Choose software that offers:

Real-time progress tracking

Detailed reports

These tools allow both you and your clients to monitor the status of disputes and credit score changes. Clients who receive regular updates are 25% more likely to remain satisfied with the service.

4. Communication Tools

Effective communication is also a must-have when doing credit repair. Look for software that includes:

Secure messaging

Email templates

Notification alerts

These features can improve client communication by up to 50%, ensuring clients feel informed and supported throughout the process.

5. Financial Education Resources

Providing clients with educational resources can enhance their understanding of credit repair and improve their financial habits. Software that includes:

Easy to follow videos

Interactive tools

These resources can boost client engagement and, helping them achieve better long-term results.

With these key features, you can offer a thorough and effective service. This will help you meet the needs of your clients and supports the growth of your business.

The Future of Credit Repair Software: Trends to Watch in 2024

In 2024, staying ahead of the curve is crucial for any business in the credit repair industry. Understanding what’s next in the industry can help you offer better services and achieve greater success.

Here are key trends to watch:

1. Integration with AI and Machine Learning

Imagine having a software that learns and improves over time, offering smarter solutions for your clients. AI and machine learning can automate complex tasks, provide predictive insights, and tailor recommendations to each client's unique situation.

Using credit repair AI, you can deliver more effective and personalized services, setting you apart from competitors.

2. Enhanced Security Features

With the recent microsoft blue screen of death outage, we can all agree that data security is more important than ever. Your clients trust you with their sensitive information, and safeguarding it should be a top priority. Modern credit repair software includes advanced security features like robust encryption and multi-factor authentication.

By ensuring your software has these protections, you not only comply with regulations but also build trust with your clients.

3. Mobile Accessibility

Your clients are always on the go, and they expect to manage their credit repair process wherever they are. Mobile-friendly credit repair software enables clients to track progress, communicate with you, and access reports from their smartphones.

Offering a mobile app can significantly enhance client satisfaction and engagement, making your services more convenient and accessible.

4. Customizable Client Portals

Every client is unique, and they appreciate services that reflect their individual needs. Customizable client portals allow you to provide a personalized experience for each client. These portals can be tailored with specific features, progress tracking, and communication tools, making clients feel valued and understood.

5. Integration with Financial Wellness Tools

Credit repair is just one piece of the financial health puzzle. By integrating your credit repair software with financial wellness tools like budgeting apps and credit monitoring services, you offer clients a comprehensive approach to improving their financial well-being. This holistic view can enhance client outcomes and demonstrate your commitment to their long-term success.

By keeping these trends in mind and incorporating them into your business strategy, you can ensure that your credit repair services remain cutting-edge and valuable to your clients.

Need a Hand?

At Disputely, we’re transforming the credit repair business software and dispute outsourcing through innovative software solutions. If you want to grow your business in this digital era and need a little bit of guidance, don’t hesitate to give us a call or send us an inquiry.

Let’s take your credit repair business to the next level in 2024.