How to Easily Apply for a Credit Card

"Did you know that 80% of Americans have at least one credit card, yet many first-time applicants get denied? Don't be part of that statistic.

Whether you're building credit from scratch or looking to maximize rewards, this guide will give you the essential steps, insider tips, and facts to confidently apply for your first credit card."

TABLE OF CONTENTS

Why You Should Get a Credit Card

Understanding Credit Card Basics

How to Choose the Right Credit Card

Steps to Apply for a Credit Card

Example: How to Apply for a Credit Card Online

Tips for Getting Approved

Using Your Credit Card Responsibly

FAQs About Credit Cards for Beginners

Conclusion

Why You Should Get a Credit Card

A credit card is a powerful financial tool. Not only does it give you access to credit for emergencies and purchases, but it also helps you build a credit history, which is important when you want to buy a house, get a car loan, or even rent an apartment.

Here are some benefits of having a credit card:

Build Credit: Credit cards help you build your credit score by showing that you can borrow money and pay it back responsibly.

Access Rewards: Many credit cards offer rewards such as cashback, travel miles, or points for everyday purchases.

Convenience: You don’t have to carry cash, and you can make purchases online easily.

Fraud Protection: Credit cards often offer better protection against fraud than debit cards, meaning you’re less likely to lose money if someone steals your card information.

If you use your credit card wisely, you can take advantage of these benefits while building a good financial foundation.

Understanding Credit Card Basics

Credit card is a must have specially if you have no credit score yet. Before you apply for a credit card, it’s important to understand some key terms and how credit cards work.

Credit Limit: This is the maximum amount you can borrow on your credit card. For example, if your limit is $1,000, you can’t spend more than that unless you pay off part of your balance.

Annual Percentage Rate (APR): This is the interest rate you’ll pay if you don’t pay off your credit card balance in full each month. The higher the APR, the more interest you’ll pay on balances carried over month-to-month.

Minimum Payment: This is the smallest amount you must pay each month. However, only paying the minimum will mean paying interest on the remaining balance.

Rewards: Some cards offer rewards, like points or cashback, for every dollar you spend. These rewards can add up over time, giving you perks like free flights or money back.

Secured vs. Unsecured Cards: If you don’t have a credit history or have bad credit, you might start with a secured credit card, which requires a deposit. Unsecured cards don’t require a deposit and are more common once you’ve established credit.

Understanding these terms will help you make better decisions when applying for your first card.

How to Choose the Right Credit Card

Not all credit cards are created equal, and it’s important to pick the one that fits your needs. Here’s what to consider:

Interest Rates: If you plan to carry a balance, choose a card with a low Annual Percentage Rate (APR). This will save you money on interest.

Rewards: Some cards offer cashback, while others offer travel points. Think about what rewards are most valuable to you. For example, if you travel a lot, a card with travel rewards might be the best choice.

Fees: Some credit cards come with annual fees, while others don’t. Be sure to check for hidden fees like late payment penalties or balance transfer fees.

Credit Limit: Look for a card that offers a credit limit that fits your budget. You want a limit that allows flexibility without encouraging overspending.

Secured Cards: If you’re new to credit or have a low credit score, consider a secured card. These cards require a deposit but are easier to get approved for and are a great way to build or rebuild credit.

Start by researching different types of cards, like student credit cards, beginner cards, or secured cards if you’re just starting out. Pick a card that matches your spending habits and financial goals.

Steps to Apply for a Credit Card

Now that you know what kind of card you want, let’s walk through the steps to apply for a credit card. Follow these steps carefully to ensure a smooth application process.

1. Check Your Credit Score

Your credit score is important when applying for a credit card. Most credit card companies require a fair or good credit score. If you don’t have a credit score yet, consider starting with a secured card or a card designed for beginners. You can check your credit score for free on websites like IdentityIQ or your bank’s app.

2. Gather Your Information

To apply for a credit card, you’ll need the following information ready:

Full legal name

Social Security number

Date of birth

Employment status and income

Address and contact details

Make sure all the information is correct because mistakes can delay the approval process.

3. Apply Online or In Person

The easiest way to apply for a credit card is online. Most banks and credit card issuers offer simple online applications. You can also apply in person at a bank if you prefer a face-to-face experience.

4. Wait for Approval

After submitting your application, the card issuer will review your credit score and financial details. Some applications offer instant approval, but others might take a few days to review. You’ll receive an email or letter letting you know if you’re approved or denied.

How to Apply for a Credit Card Online

To help you visualize the process, here’s a step-by-step example of how to apply for a credit card online. Let’s say you’re applying for a Discover It® Secured Card, which is designed for people with no credit or bad credit.

Step 1: Visit the Website

Example, you want a Discover card. Go to the official Discover website by typing www.discover.com in your browser.

Step 2: Find the Credit Card Section

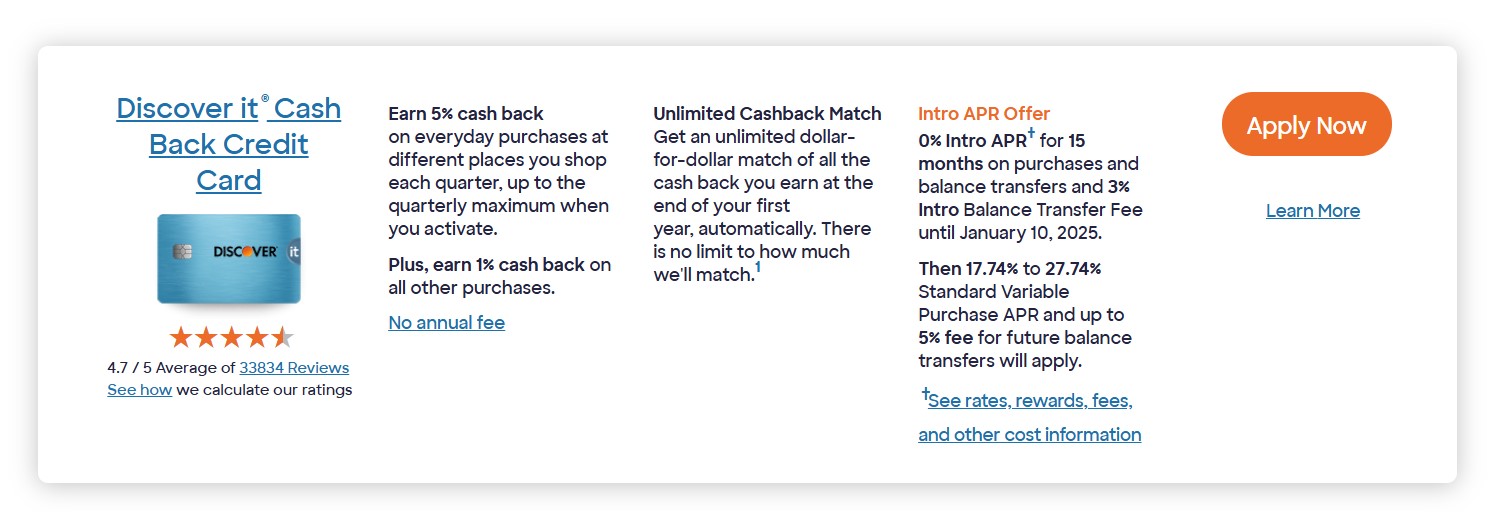

Click on the “Credit Cards” tab at the top of the page. Browse through the available cards, and select Discover It® Secured Card.

Step 3: Click "Apply Now"

Once you’ve selected the card, click the “Apply Now” button.

Step 4: Fill Out the Application

Enter all the required information such as your full name, Social Security number, date of birth, income, and address. Make sure the information is accurate to avoid delays.

Step 5: Submit Your Application

After filling out the application, review the information one last time, then click “Submit.”

Step 6: Wait for a Response

After submitting, Discover will review your application. If approved, you’ll be asked to provide a security deposit for the secured card (typically $200 or more). Once that’s done, you’ll receive your card in the mail in about 7-10 business days.

Tips for Getting Approved

Getting approved for a credit card depends on several factors, including your credit history and financial situation. Here are some tips to increase your chances:

Start with a Secured Card: If you have no credit history or bad credit, applying for a secured card can help you build credit. Since secured cards require a deposit, they are easier to get approved for.

Keep Your Debt Low: If you already have loans or credit, make sure your debt is manageable. Lenders prefer people who aren’t using too much of their available credit.

Don’t Apply for Too Many Cards: Applying for too many credit cards in a short period can hurt your chances. It can also lower your credit score because each application adds a “hard inquiry” to your credit report.

Build a Credit History: If you don’t get approved right away, focus on building credit with other financial products, like a secured credit card or a credit-builder loan. Over time, your score will improve, making it easier to get approved for better cards.

Using Your Credit Card Responsibly

Once you’ve been approved for a credit card, it’s important to use it responsibly. Here’s how:

Pay Your Balance in Full: Try to pay off your balance every month to avoid paying interest. Carrying a balance from month to month will cost you more money in the long run.

Make Payments on Time: Late or missed payments can hurt your credit score. Set up automatic payments or reminders to make sure you never miss a due date.

Keep Your Credit Utilization Low: Your credit utilization rate is the amount of credit you’re using compared to your total credit limit. Try to keep this below 30%. For example, if your limit is $1,000, try not to spend more than $300.

Monitor Your Account: Regularly check your credit card account for any unauthorized charges or unusual activity.

Using your credit card wisely will help you build a strong credit history and improve your credit score over time.

FAQs About Credit Cards for Beginners

1. What is a secured credit card?

A secured credit card requires a deposit that acts as your credit limit. It’s a great option for people with no credit history or a low credit score because it’s easier to get approved.

2. Will applying for a credit card hurt my credit score?

When you apply for a credit card, it triggers a hard inquiry on your credit report. While this can cause a small dip in your credit score, the impact is usually temporary.

3. How long does it take to get approved for a credit card?

Many applications offer instant approval, but some may take a few days to process. If you’re approved, you’ll typically receive your card within 7-10 business days.

4. What happens if my credit card application is denied?

If your application is denied, the credit card issuer will send you a letter explaining why. You can work on improving your credit and reapply in the future.

5. Can I apply for a credit card with no credit history?

Yes! Many cards are designed for people with no credit history, like student credit cards or secured cards. These cards are great for building credit.

Conclusion

Applying for a credit card is a big step toward building your financial future. Whether you’re aiming for your first card or trying to rebuild your credit, following these steps will help you find the right card and get approved. Remember, using your credit card responsibly is just as important as getting approved. Pay your bills on time, keep your spending in check, and monitor your account regularly.

With the right credit card and smart financial habits, you’ll be on your way to building a strong credit score and unlocking better financial opportunities in the future.

If you find errors on your credit report or face rejection due to credit issues, Disputely can help you take control of your credit repair journey. Our AI-driven platform simplifies the dispute process, tracks your progress, and helps remove inaccurate information quickly and efficiently. Take the next step toward financial freedom with AI credit repair and ensure your credit is always in top shape.