A.I.-Powered

Outsourcing

Service

For CRO's!

Embrace the efficiency of automation and outsourcing to elevate your credit repair services, ensuring cost savings, time optimization, and unparalleled client satisfaction.

A.I.-Powered

Outsourcing Service

For CRO's!

Embrace the efficiency of automation and outsourcing to elevate your credit repair services, ensuring cost savings, time optimization, and unparalleled client satisfaction.

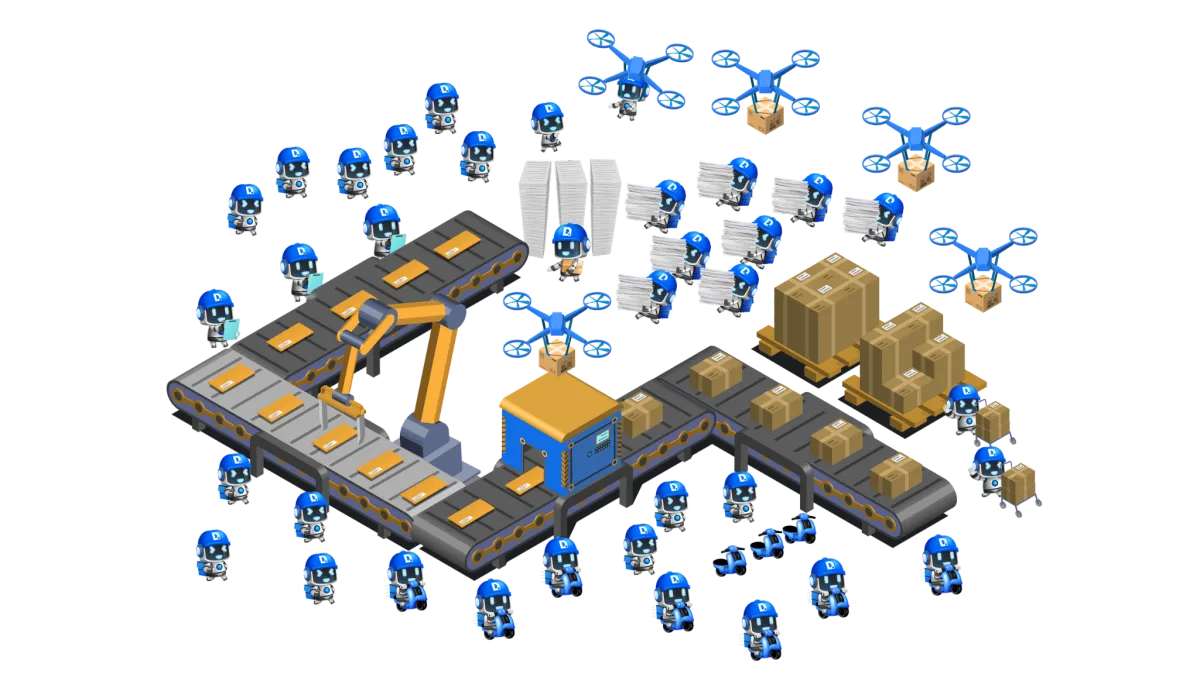

WELCOME TO DISPUTE.LY A.I. OUTSOURCING

Dispute.Ly harnesses the power of cutting-edge artificial intelligence software to revolutionize credit repair services, empowering both credit repair companies and their clients to achieve their financial goals with greater efficiency and effectiveness.

WELCOME TO DISPUTE.LY A.I. OUTSOURCING

Dispute.Ly harnesses the power of cutting-edge artificial intelligence software to revolutionize credit repair services, empowering both credit repair companies and their clients to achieve their financial goals with greater efficiency and effectiveness.

LEVERAGE THE POWER OF

OUTSOURCING WITH DISPUTE.LY A.I.

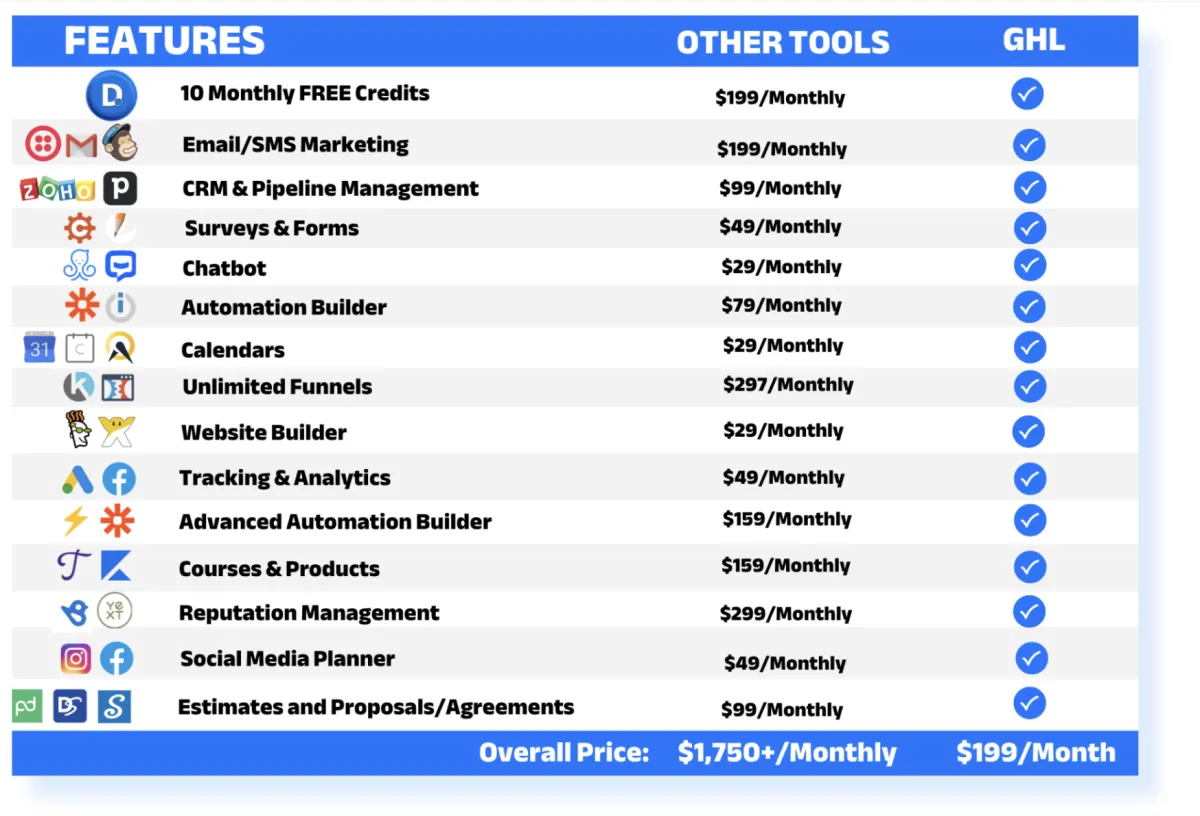

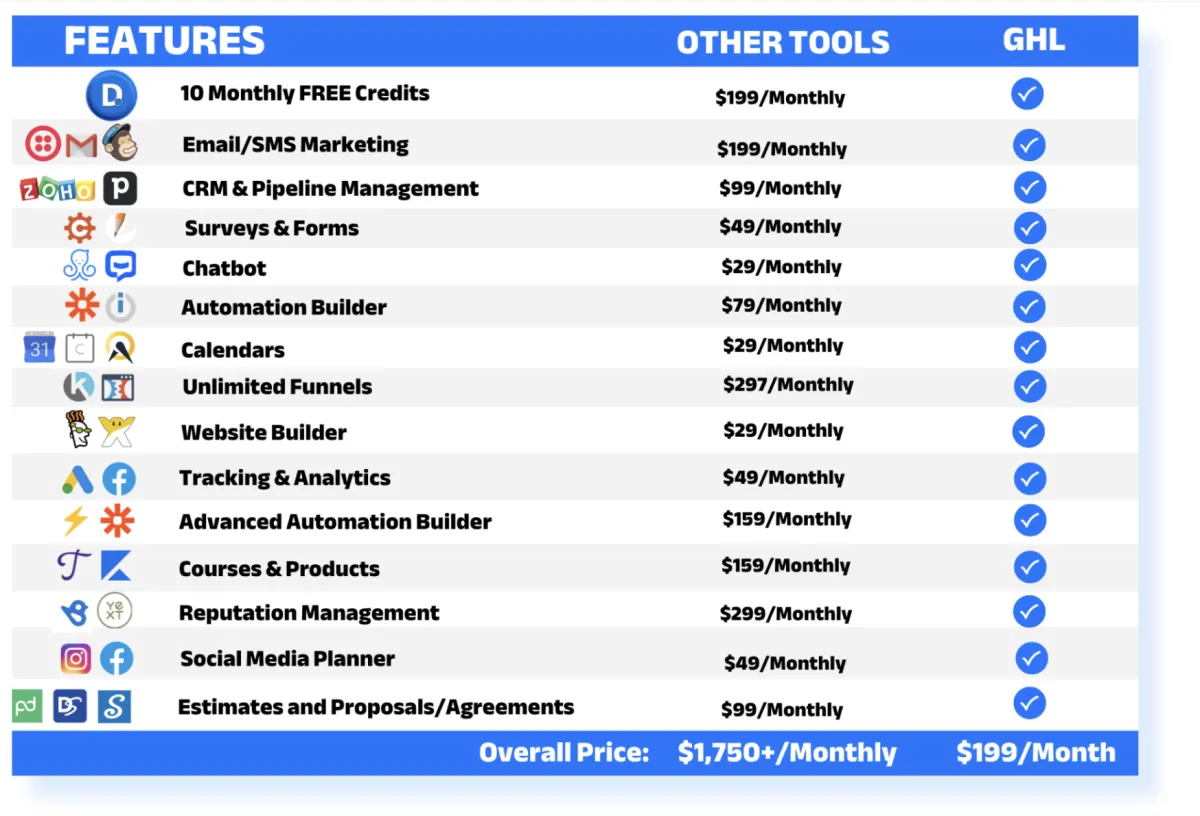

10 FREE CLIENTS PROCESSED EVERY MONTH!

Get access to a Dispute.Ly A.I. membership with a FREE GoHighLevel Account which will give you unlimited access to manage your Credit Repair Business with ease. Automate your business workflows and outsource the heavy lifting with the power of A.I.

$199/Month Outsourcing Membership

CREDIT REPAIR

OUTSOURCING PLAN

HOW IT WORKS:

Credit Repair Business Owner Registers to Become a Member of Dispute.Ly A.I. Outsourcing Program

Credit Repair Business Owner Receives access to a fully automated CRM with all the features and workflows needed to run their business

Credit Repair Business Owner Receives 10 FREE Dispute.Ly Credits every month and can add more credits to their balance on a "pay as you go" basis.

Credit Repair Business Owner will use CRM to communicate to the Dispute.Ly team when clients are ready to be processed

Dispute.Ly Team will process disputes for clients and update the Credit Repair Business Owner and the client using

HOW IT WORKS:

Credit Repair Business Owner Registers to Become a Member of Dispute.Ly A.I. Outsourcing Program

Credit Repair Business Owner Receives access to a fully automated CRM with all the features and workflows needed to run their business

Credit Repair Business Owner Receives 10 FREE Dispute.Ly Credits every month and can add more credits to their balance on a "pay as you go" basis.

Credit Repair Business Owner will use CRM to communicate to the Dispute.Ly team when clients are ready to be processed

Dispute.Ly Team will process disputes for clients and update the Credit Repair Business Owner and the client using

WHAT'S INCLUDED IN DISPUTE.LY A.I

OUTSOURCING MEMBERSHIP

10 FREE CLIENTS PROCESSED EVERY MONTH!

SAME DAY PROCESSING OF DISPUTES & RESULTS

10 YEAR + DEDICATED DISPUTE TEAM

24/7 AUTOMATION EXPERT & TECH TEAM SUPPORT

WHAT'S INCLUDED IN DISPUTE.LY A.I OUTSOURCING MEMBERSHIP

10 FREE CLIENTS PROCESSED EVERY MONTH!

SAME DAY PROCESSING OF DISPUTES & RESULTS

10 YEAR + DEDICATED DISPUTE TEAM

24/7 AUTOMATION EXPERT & TECH TEAM SUPPORT

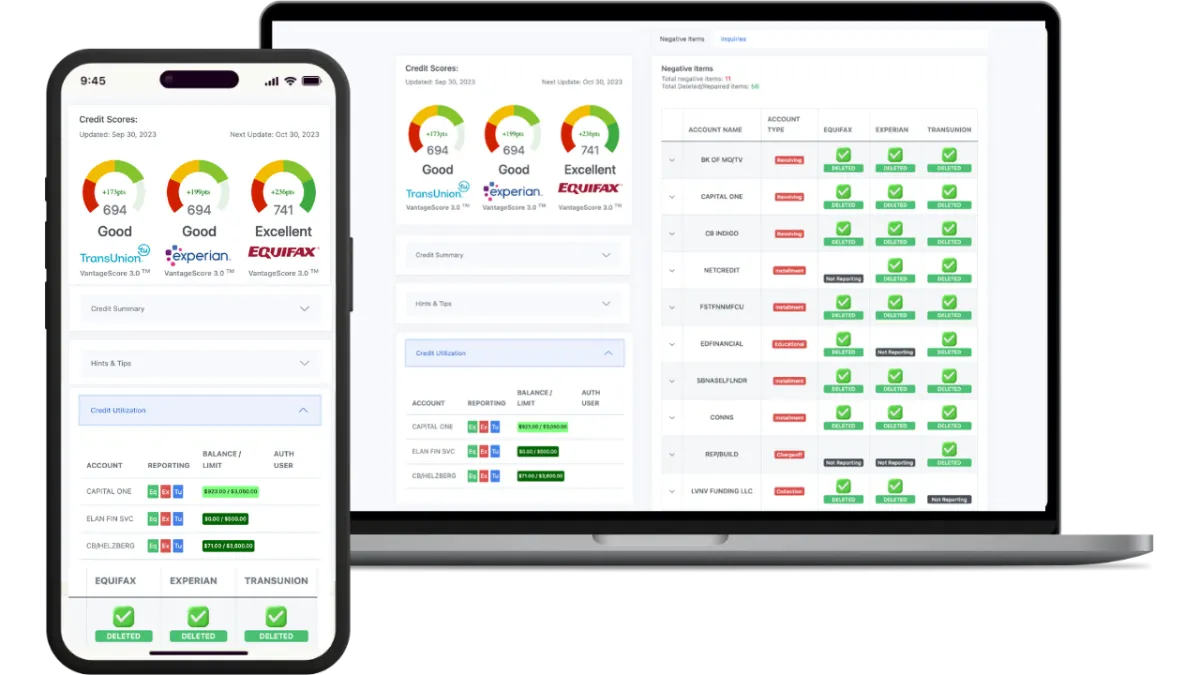

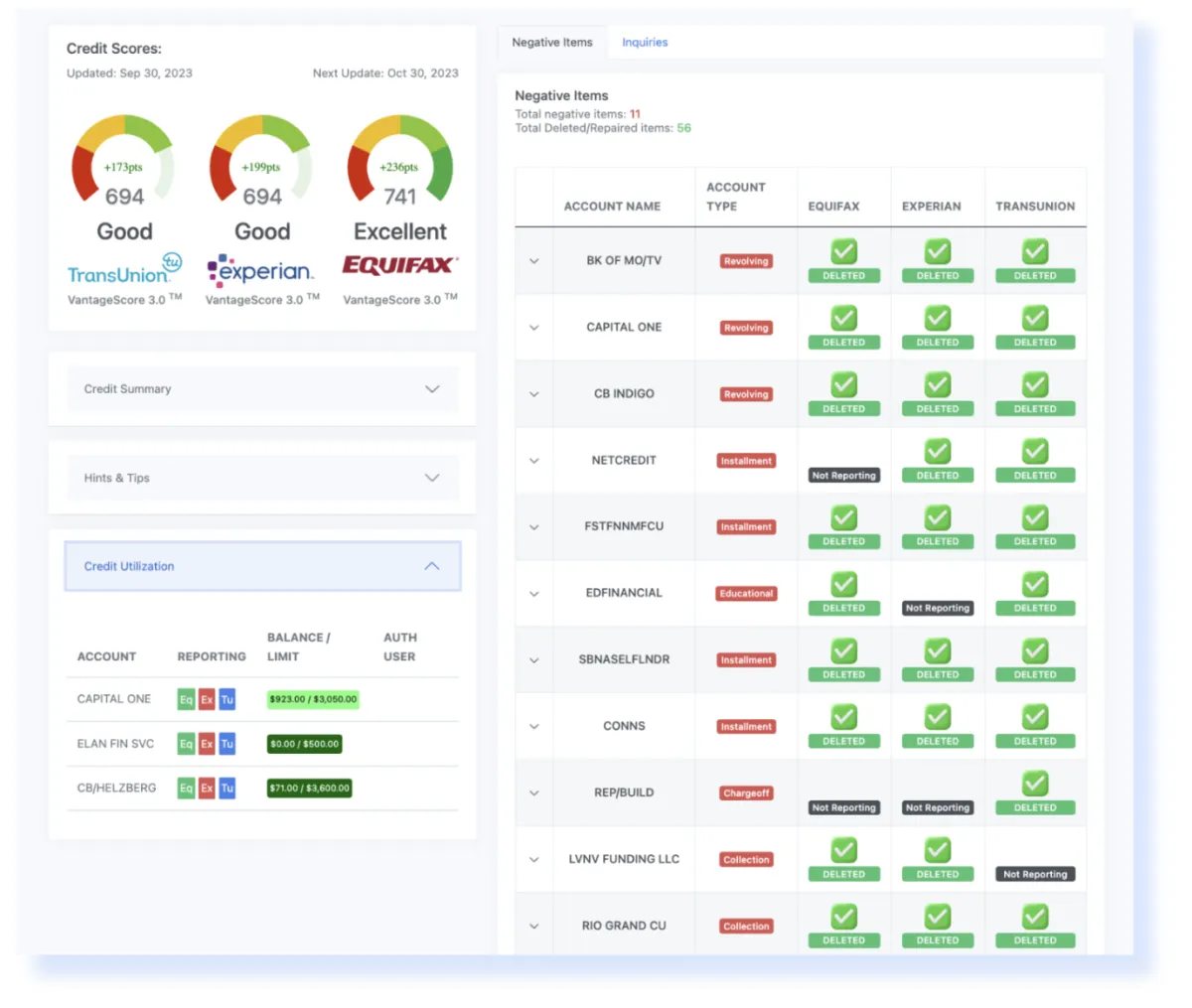

CUSTOM THEMED PROGRESS REPORTS/PORTALS

FULLY AUTOMATED CRM (GOHIGHLEVEL)

CUSTOM THEMED PROGRESS REPORTS/PORTALS

FULLY AUTOMATED CRM (GOHIGHLEVEL)

SHOP OUR DISPUTELY STORE

ADD DIGITAL PRODUCTS TO YOUR MARKETING STRATEGIES

AND BRING REVENUE TO YOUR BUSINESS

EBOOKS, FUNNELS, CUSTOM AUTOMATIONS, GRAPHIC DESIGNS & MORE!

Get In Touch

Email: [email protected]

Address

15915 Katy Fwy, Houston, TX 77094

Assistance Hours

Mon – Sat 8:00am – 5:00pm

Sunday – CLOSED

Phone Number:

346-202-4303

Office: 15915 Katy Fwy,

Houston, TX 77094

Call 346-202-4303

Email: [email protected]

Site: www.Disputelyai.com