15 Easy Ways to Fix Your Credit and Boost Your Score

Are you looking for easy ways to fix your credit and improve your financial health?

Your credit score plays a crucial role in your ability to secure loans, rent an apartment, or even land a job.

So how do you improve your credit score?

What strategic steps can you take to repair damaged credit and build a healthier financial future?

Most importantly, how can you sustain these improvements for long-term financial stability?

Fortunately, there are several straightforward strategies you can implement today to start boosting your credit score.

Whether you're aiming to recover from past financial setbacks or simply want to strengthen your credit standing, this article will help you out.

We’ve curated 15 effective methods to help you fix your credit. These methods are divided into 5 main sections, offering you structured answers to these questions.

Assess Your Credit Report: The first step in fixing your credit is understanding where you stand. You’ll first need to know how to access and interpret your credit report. This will enable you to identify any errors or areas for improvement.

Pay Down Existing Debts: High levels of debt can weigh down your credit score. Learn effective methods to prioritize and pay off your existing debts strategically.

Improve Payment History: Your payment history is a significant factor in your credit score. Discover practical tips to ensure you make timely payments and boost your creditworthiness.

Manage Credit Utilization: Credit utilization ratio plays a critical role in your credit score. Find out how to optimize this ratio to positively impact your credit standing.

Alternative Options: Explore additional strategies and alternative options for improving your credit score, including lesser-known tactics that can make a significant difference.

Be sure to read to the end. We share best practices for maintaining a strong credit score and achieving financial success.

Let’s get started.

Fix Your Credit By Assessing Your Credit Report

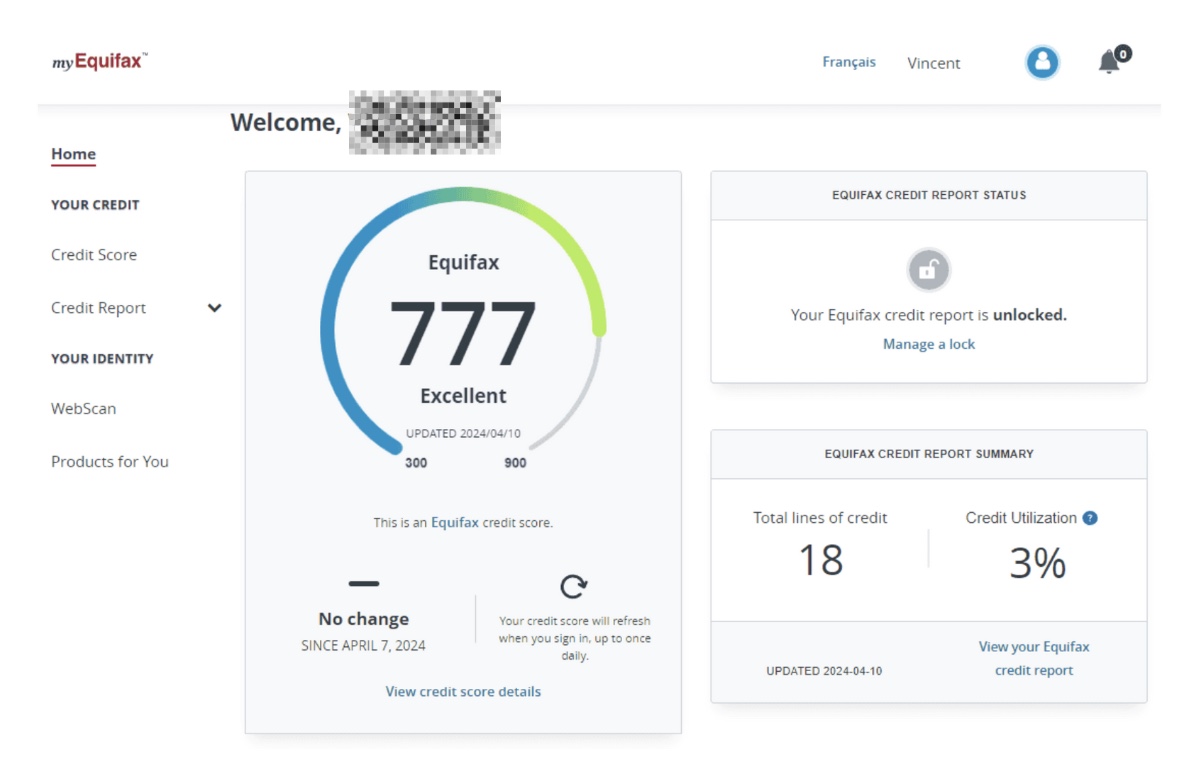

1. Obtain Your Credit Report

To kickstart your credit repair journey, it's crucial to assess your credit report. Begin by obtaining a copy of your credit report to gain a clear understanding of your current financial standing. This initial step lays the foundation for identifying areas that require improvement and developing a tailored strategy to enhance your credit score.

You can get your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). You're entitled to a free report from each bureau every 12 months through AnnualCreditReport.com.

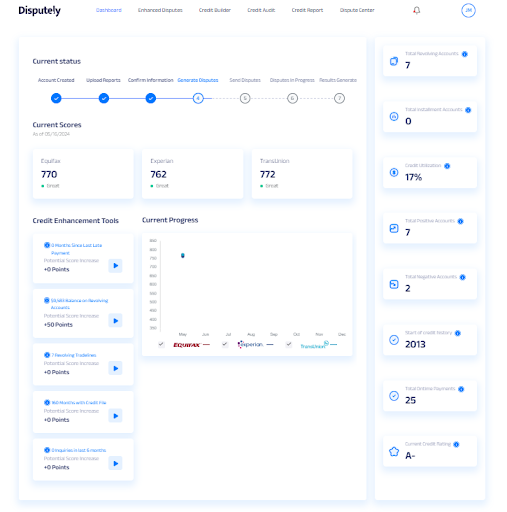

2. Identify and Dispute Errors

To fix your credit, start by carefully reviewing your credit reports. You can use credit repair software to effectively do this. Look for any inaccuracies, such as incorrect account information or signs of fraudulent activity. These errors can seriously affect your credit score.

Credit repair software simplifies the process. It scans your credit reports for common errors, highlighting issues like wrong personal details, accounts that don’t belong to you, and incorrect account statuses. Once identified, the software guides you through the process of disputing these errors with the credit bureaus.

Provide any necessary documentation through the software, such as bank statements or emails, to support your dispute. The software can often automate communications with the credit bureaus, making it easier and faster to get errors corrected.

Correcting these mistakes can significantly improve your credit score, helping you secure loans, credit cards, and better interest rates.

3. Monitor Your Credit Regularly

After addressing errors on your credit report, it's crucial to monitor your credit regularly. Credit repair software offers robust features to help with this task. These tools provide real-time alerts and detailed reports, enabling you to stay on top of your credit status.

Regular monitoring allows you to track your progress and quickly identify any new issues. Many credit repair programs offer daily or weekly updates, so you can see changes as they happen.

For instance, if a new account is opened in your name or if your credit score changes, you'll receive immediate notifications. This proactive approach helps you address potential problems before they escalate.

According to a study by the Federal Trade Commission, one in five people had an error on at least one of their three credit reports. Regular monitoring through credit repair software can help you catch and dispute these errors promptly.

Many banks and financial institutions offer free credit monitoring services, but credit repair software often provides more comprehensive features. These may include identity theft protection, personalized advice on improving your credit score, and tools to track your spending and debt levels.

You might be interested in: Why Use Credit Repair Software To Fix Your Credit

By leveraging the advanced features of credit repair software, you can ensure that your credit remains healthy and that any issues are addressed quickly and efficiently.

Increase Your Credit Score Quickly By Paying Existing Debts

Now that you’ve fixed errors and are monitoring your credit, it's time to take action. Next, focus on paying off debt to improve your credit score.

4. Create a Debt Repayment Plan

Develop a realistic repayment plan for your debts. Prioritize paying off high-interest debts first while making minimum payments on others. This strategy, known as the avalanche method, reduces the total interest paid over time.

Below is a clear step by step sample of an effective repayment plan:

List All Your Debts: Write down all your debts, including the amount owed, interest rates, and minimum monthly payments. This gives you a complete picture of your financial situation.

Prioritize High-Interest Debts: Focus on paying off high-interest debts first while making minimum payments on others. This method, called the avalanche method, reduces the total interest you pay over time.

For example, if you have credit card debt with a 20% interest rate and a student loan with a 5% interest rate, pay extra towards the credit card debt first.

Set a Budget: Create a realistic budget that includes your debt repayment goals. Track your spending to make sure you can afford these payments without sacrificing essential needs.

Stick to Your Plan: It’s important to stay committed to your repayment plan. Avoid new debts and stick to your budget.

By following these steps, you can reduce your debt faster and save money on interest.

5. Negotiate with Creditors

If you feel your income or cash flow isn’t enough to pay your debt. The only solution is to get in touch with your creditors. Contact your creditors to negotiate lower interest rates or more favorable payment terms. Some creditors may offer hardship programs or settlement options if you're struggling to make payments.

Talking to your creditors can make a big difference.

Here’s what to do:

Contact Your Creditors: Call your creditors and explain your situation. Be honest and polite. Let them know if you’re facing financial difficulties.

Request Lower Interest Rates: Ask if they can lower your interest rate. A lower rate means you’ll pay less interest over time, making it easier to pay off your debt.

Ask for Better Payment Terms: See if they can offer more favorable payment terms, such as a longer repayment period or reduced monthly payments.

Inquire About Hardship Programs: If you’re struggling to make payments, ask if they have hardship programs. These programs may offer temporary relief, such as reduced payments or paused interest accrual.

Explore Settlement Options: In some cases, creditors may be willing to settle for a lump sum payment that’s less than the total amount owed. This can be a good option if you have some money saved up.

Many creditors are willing to help if you reach out and ask.

Negotiating can lower your monthly payments and make your debt more manageable.

6. Consolidate Your Debts

Now that you've started negotiating with creditors to improve your payment terms, consider consolidating your debts. This can simplify your financial life and save you money on interest.

Debt Consolidation Loans: Look into consolidating multiple debts into a single loan with a lower interest rate. By combining debts like credit cards, personal loans, or medical bills into one manageable payment, you can reduce the total interest you pay and streamline your finances.

Benefits of Consolidation: Consolidation not only simplifies your monthly payments but also helps you stay organized and focused on paying down your debt faster. You'll have a clear roadmap to becoming debt-free without the stress of managing multiple payments.

Balance Transfer Credit Cards: Another option is using balance transfer credit cards to consolidate high-interest credit card debt. These cards often offer a low or 0% introductory interest rate for a certain period, allowing you to pay off your debt without accruing additional interest charges.

By consolidating your debts, you take a proactive step towards financial freedom. It's a strategic move that can significantly improve your financial well-being and help you achieve your long-term financial goals.

Improve Payment History To Boost Your Score

If you really want to see your credit score transition from poor to good, you have to prove it.

But how?

Improving how you manage your payments can make the difference. Don’t let those past mistakes hold you back. Show those creditors that you become financially responsible,

Here’s how you can make it work for you:

7. Make Payments on Time

Your payment history is the most significant factor affecting your credit score. Ensure all your bills are paid on time, including credit cards, loans, and utilities. Late payments can seriously drag down your score, so it's crucial to prioritize staying on top of due dates.

Set Up Automatic Payments: Automating your bill payments ensures you never miss a due date, which helps you build a strong payment history effortlessly.

Use Reminders: If you prefer to handle payments manually, set reminders on your phone or calendar to stay organized and avoid late fees.

Consistently paying on time shows lenders that you're reliable and responsible, which can lead to better credit opportunities.

8. Pay More Than the Minimum

Paying more than the minimum on your credit cards is another powerful way to improve your creditworthiness:

Reduce Debt Faster: Paying more than the minimum helps you pay off your debt quicker, saving you money on interest over time.

Lower Credit Utilization: It also lowers your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. Keeping this ratio below 30% can positively impact your credit score.

Focus on paying off debts with higher interest rates first while making extra payments on others. This proactive approach sets you on the path to financial stability and better credit health.

Manage Credit Utilization

9. Reduce Credit Card Balances

High credit card balances can negatively affect your credit score. Aim to keep your credit utilization ratio below 30% of your total available credit. This shows lenders you’re not maxing out your credit and can handle it responsibly.

We also recommend paying down your balances to quickly improve your score. Start by tackling the cards with the highest balances and work your way down. This method can quickly improve your credit score by reducing your overall credit utilization.

Strategic Payment Example:

Let’s say you have two credit cards.

Card A: $5,000 balance with an 18% interest rate.

Card B: $2,000 balance with a 15% interest rate.

Your strategy should be to prioritize paying off Card A aggressively while making minimum payments on Card B. By allocating extra funds towards Card A each month—let’s say $500—while paying the minimum on Card B, you can reduce the balance on Card A faster.

After a few months of disciplined payments, Card A's balance could decrease significantly, reducing your overall credit utilization ratio.

This proactive approach not only improves your credit score but also saves you money on interest payments over time.

By actively managing and strategically reducing your credit card balances, you demonstrate financial responsibility and improve your creditworthiness step by step.

10. Request Higher Credit Limits

Another effective strategy to improve your credit score is to request higher credit limits on your existing credit cards.

Why does this work?

By increasing your total available credit while maintaining your current spending habits, you can lower your credit utilization ratio.

This ratio measures how much of your available credit you're using at any given time. Ideally, you want to keep this ratio low, as it demonstrates responsible credit management to lenders.

However, be mindful when requesting higher limits. Each request typically triggers a hard inquiry on your credit report, which can temporarily lower your score. It's important not to overextend yourself financially just because you have a higher limit.

Responsible spending and timely payments are crucial to benefiting from this strategy.

Other strategies to easily fix your credit

11. Become an Authorized User

Another method to potentially boost your credit score is by becoming an authorized user on someone else's credit card account.

This person is typically a family member or friend who has a solid credit history. When you're added as an authorized user, their positive payment history and credit utilization can reflect positively on your credit report.

This strategy can be particularly helpful if you're trying to establish or rebuild your credit.

It's important to choose someone who manages their credit responsibly, as any missed payments or high balances on that account could negatively impact your credit score as well.

12. Apply for a Secured Credit Card

If you have poor or limited credit history, applying for a secured credit card can be a practical step towards building or rebuilding your credit.

Secured credit cards require a cash deposit as collateral, which typically determines your credit limit. The deposit protects the issuer in case you default on payments.

To benefit your credit score, use the secured card responsibly. Make small purchases and pay off the balance in full each month. Over time, this demonstrates your ability to manage credit responsibly, which can lead to improved credit scores and potentially qualify you for an unsecured credit card in the future.

13. Avoid Closing Old Accounts

Your credit history plays a significant role in your credit score calculation. Closing old credit card accounts, especially those with a long history of on-time payments, can shorten your overall credit history. Additionally, it can increase your credit utilization ratio if you have outstanding balances on other cards.

Even if you're not actively using an old account, consider keeping it open. Regularly charging a small amount and paying it off can help keep the account active and benefit your credit score in the long run.

14. Limit New Credit Applications

Each time you apply for new credit, the lender typically conducts a hard inquiry on your credit report.

These inquiries can temporarily lower your credit score. Applying for multiple credit accounts within a short period can signal to lenders that you may be financially stressed or overextending yourself.

To minimize the impact on your credit score, be selective and strategic about applying for new credit. Only apply for credit when you genuinely need it and have a good chance of being approved.

15. Address Collections Accounts

If you have accounts that have been sent to collections due to non-payment, it's crucial to address them to improve your credit score. Contact the collection agency to negotiate a payment plan or settlement.

Ensure that any agreement you reach includes having the account marked as "paid" or "settled" on your credit report. This is important because a collection account, even if paid, can significantly impact your credit score until it's resolved.

Fixing Your Credit is Easy… If you know the steps

Improving your credit score is a gradual process that requires discipline and strategic financial management.

By implementing these 15 strategies, you can take significant steps towards repairing your credit and building a stronger financial future.

Remember, it's essential to regularly monitor your credit report, manage your debts responsibly, and protect your credit history to maintain and improve your credit score over time. With persistence and responsible financial habits, you can achieve your credit score goals and access better financial opportunities in the future.

Debt, bad credit scores, and financial stress can’t wait.

In these challenging times, your financial health is more crucial than ever. Waiting for the perfect moment to act can make your financial situation worse over time.

At Disputely A.I. we’re here to help. We offer comprehensive credit repair software designed to streamline your credit repair process, provide in-depth credit evaluations, and empower you to take control of your financial future.

Ready to make a change? Speak to a specialist today and become a member.

Don’t let bad credit hold you back—let’s build a better financial future together.